The voluntary carbon markets are estimated to have a turnover in 2022 in the order of US$ 2 billion. Current estimates are often quickly followed by forecasts that turnover could reach US$ 50 billion by 2030.

Reports from government departments, United Nations climate bodies and NGOs like the World Economic Forum state that the commercial and financial efforts to commoditise CO2 emissions will play a critical part in the fight against climate change[1]The World Economic Forum describes why the voluntary carbon market is key to scaling carbon dioxide removal and delivering net-zero.

Considering the importance of this concept, the average citizen in an industrial country knows very little about it and there is considerable confusion about what the instruments actually represent. This table summarises the basics.

| Instrument | Originates from | Represents |

|---|---|---|

| Carbon Offset | Projects capturing CO2 from the atmosphere or preventing its emission | Given amount of carbon credits used to balance out the buyer’s own CO2 emissions |

| Carbon Credit | Projects capturing CO2 from the atmosphere or preventing its emission | One tonne of CO2 that was captured or never released or will be captured (e.g. by forest growth) |

| Carbon Credit, Tokenized | Carbon market participants who place their credits on the blockchain | A carbon credit which can be securely traded in a traceable, non-fungible way |

| Carbon Allowance | Government schemes to restrict CO2 emissions | The right to emit the given quantity of CO2 |

| Carbon Emissions Permit | Auction by government of emissions rights for a specific time period | The right to emit the given quantity of CO2 during that time frame |

| Carbon Token | Carbon allowance schemes run by government to restrict CO2 emissions | A unit of allowance, e.g. right to emit a tonne of CO2 from a national carbon budget |

As laid out, the only actual similarity between all the instruments is that they are denominated in tonnes of CO2.

The main differences are more numerous, as follows, outlining the ways the CO2 concerned is considered:

- it can relate to CO2 that is avoided (the emissions were prevented), or captured at the point where emissions occur (e.g. in fossil fuel power stations), or captured from the atmosphere or other part of the environment

- it can relate to CO2 that is either captured mechanically by humans (for instance in smoke stacks), or naturally by biological or geological processes (e.g. through the growth of forests)

- it can represent captured CO2 or emissions prevention that has already happened, or is planned to happen in the future

The Structure of Carbon Credits, Permits or Tokens

How business and some private individuals deal with various carbon instruments is varied and the legal definitions and contractual obligations that are associated with the instruments are evolving all the time, but there are several basic differences distinguishing different types of instrument and the markets they are traded on:

- they can originate from a government-mandated compliance scheme, or from a voluntary, private project that has registered with a carbon registry that has its own standards

- it can have an expiry date, it can be “retired” (manually taken off the market by choice), or it can be subject to demurrage if not used (penalties)

- it can represent either the right to emit CO2, i.e. a token, permit or allowance which is valuable to the polluter who wishes to emit that CO2, or it can represent avoided or captured CO2, i.e. a credit or offset, which is valuable to any organisation which wishes to demonstrate that it runs a “carbon-neutral” operation where there are no net emissions once it has paid someone else to capture the CO2 it emitted

- some instruments are a fungible (all exactly the same), tradable commodity, some vary in quality, risk and value for the same unit size, and some are non-tradeable

Read more here on carbon offsets from an individual’s perspective: https://ecocore.org/offsetting

More in this Series

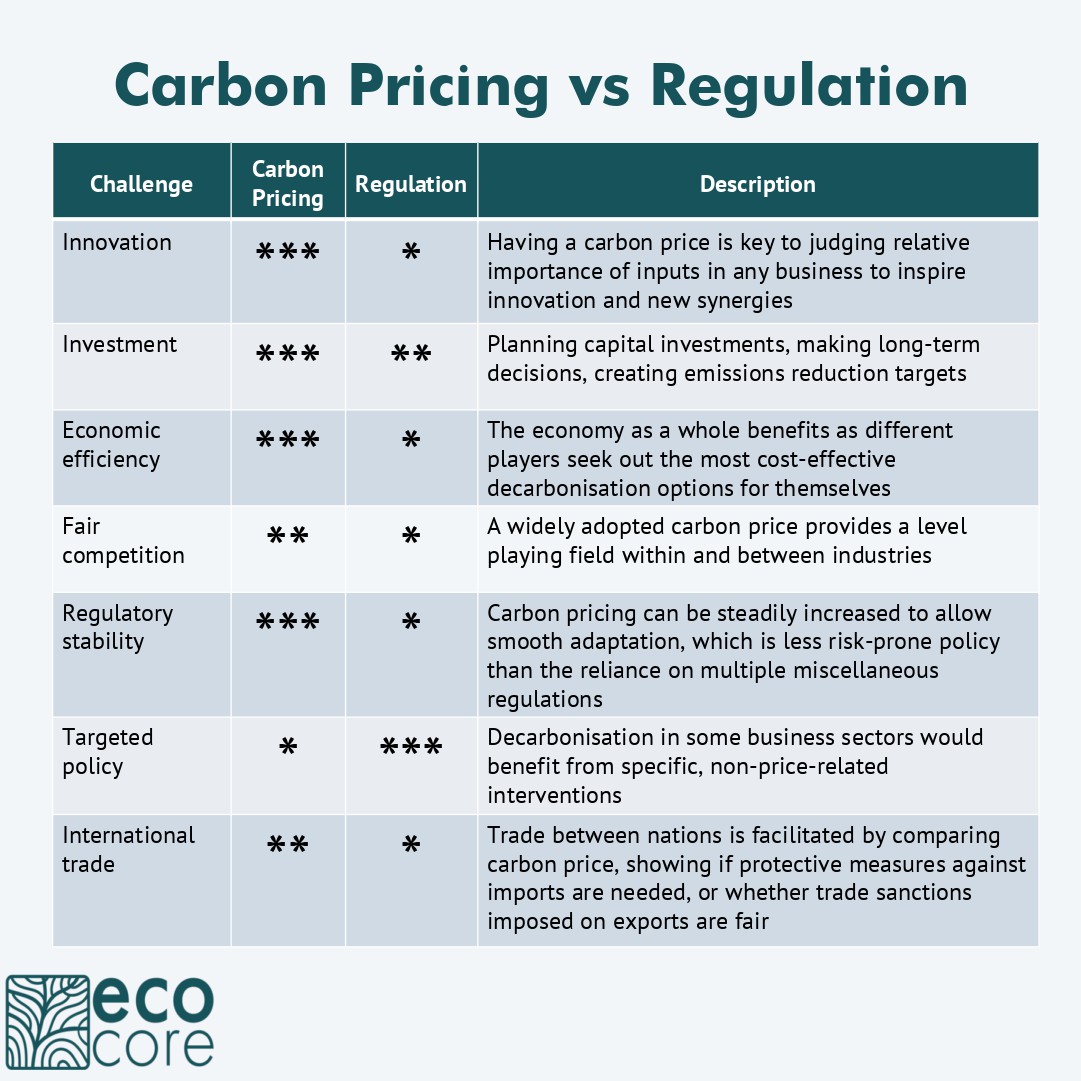

Carbon pricing: what is it? Essentially it is just information about money – the price signal, which you need if you…

The de facto industry standard for reporting CO2 is the GHG Protocol, with its omnipresent Scope 3 emissions. See the table…

A carbon price is the key factor that business, industry and the economy need for a swift and efficient energy transition.…

Despite decades of carbon trading, CO2 emissions continue to rise, and it seems little can improve the carbon markets. The impact…

EcoCore’s hypothesis is that our Carbon Accounts framework would create the strongest carbon pricing signal above any other approach to drive…

References

| ↑1 | The World Economic Forum describes why the voluntary carbon market is key to scaling carbon dioxide removal and delivering net-zero |

|---|