Updated on 2023-04-27 by Adam Hardy

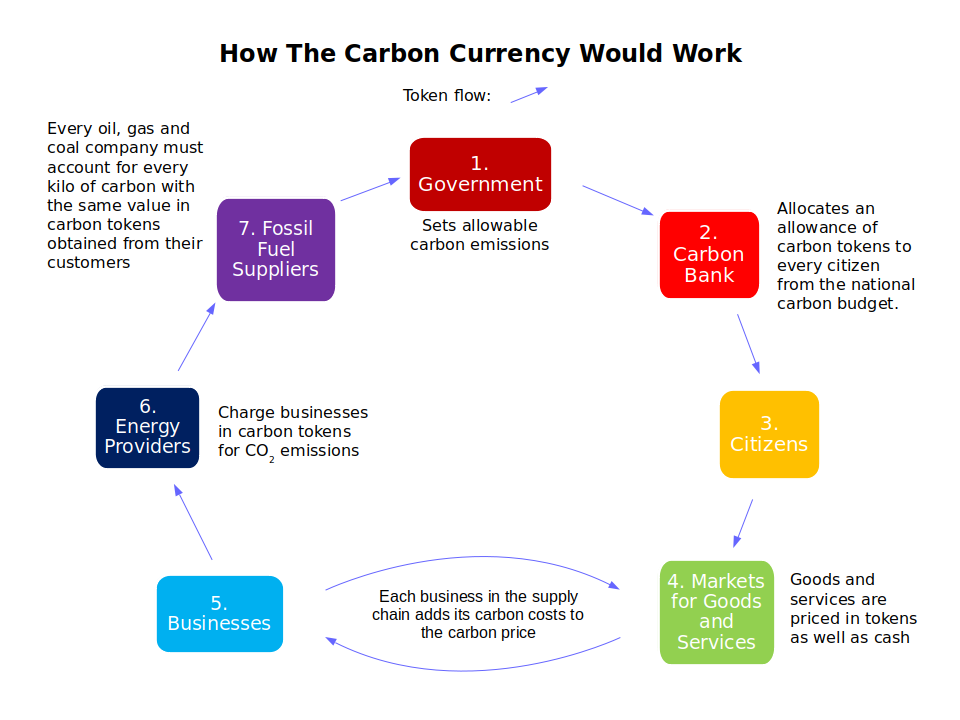

From the first second after midnight on day one of the carbon currency, every purchase and sale nationwide will involve carbon tokens as well as money. Citizens’ carbon allowances from the national budget will feed into the economy via every transaction they make. To get to this point, several extensive, wide-ranging changes to the fabric of society and the mechanics of the economy are necessary:

- the country declares the carbon budget that it is taking responsibility for, in terms of a ceiling on its CO2 emissions, in gigatonnes, and establishes the quantity to be distributed on the first day – most likely at a level which matches society’s current emissions.

- a central carbon bank is established which creates carbon accounts for individuals and organisations

- a negative interest rate is set, by which the carbon tokens in the carbon accounts depreciate, to avoid stockpiling and encourage those with excess to sell

- the national interbank payments system needs to be reprogrammed to deal with dual currencies

- Visa, Mastercard and other business-to-bank payment systems need to be reprogrammed to accept dual currency transactions

- retailers selling to the public must upgrade their POS card readers to accept the dual currency credit and debit cards

The United Kingdom introduced decimalisation in 1971 and got rid of the shilling and the guinea.

The newly unified Germany in 1990 completely replaced the Ostmark with the D-Mark.

In 1999 the EU replaced 10 currencies with the Euro

In 1999/2000 the whole world held its breath as we waited to see what the Millennium Bug would do and whether the fall-back solutions would work.

The introduction of carbon allowances with the carbon currency will be a one-time event that the country will have worked its way up to for years. Such changes have been made before for the sake of economic robustness and resilience and will no doubt be made again. With the climate crisis, the time for such incisive change in the economy has arrived.

How the Carbon Currency Works at the Start

One of the tenets of the carbon currency and allowances framework is that only citizens are given a carbon allowance. The obvious ramification is that policy makers need to decide how to ensure that the whole economy can still function on the day of introduction. Businesses and non-government organisations are not allocated carbon allowances on an ongoing basis yet they will need carbon tokens to pay for anything they purchase as their supply chains continue production and their suppliers demand carbon tokens alongside money.

The question is, what does the first company to buy a non-zero emissions product do, if it has no carbon tokens? These are the options:

- companies could borrow carbon tokens from the central carbon bank in order to cover initial outlays, or run an overdraft in their carbon accounts.

- the government could give out a grant of carbon tokens to all businesses, based on an assessment of their needs run by trustworthy carbon auditors beforehand. Such an assessment will undoubtedly be something that the businesses will want to undertake beforehand anyway, for their own business planning.

- businesses could buy the carbon tokens they require on the carbon market, where the central carbon bank will sell at a price it determines from a reserve pool of carbon tokens held back from public allocations but part of or at least strongly linked to the carbon budget for the allowance period. At the start very few citizens will be selling on the carbon market and in fact there may be restrictions on private selling during a cooling-off period.

Government organisations such as the UK National Health Service or the armed forces obtaining their funding directly from the state will have immediate access to carbon tokens (read more). The government will take a proportion of the national carbon budget to fund its own operations, which will be available to the government-run operations at the same time as the new allowances for citizens.