Updated on 2022-12-19 by Adam Hardy

Abundance Investments is ulta-green investing. They have been around for a few years now and are one of the “Best Buys” in the Innovative Finance ISAs category on the Ethical Consumer website and run their own platform for buying and selling investments in various types of low carbon future-proof organisations. I’m going to check out the opportunities and risks and the general climate-friendliness of the whole affair. I have a deep-seated mistrust of finance, due to seeing pension funds going bankrupt and watching South Park, so until now I’ve always kept my money in cash, i.e. I’m more interested in getting the money back than getting the interest.

Just in case you had any doubts, I am not an investment advisor and this article does not represent investment advice! This is just my personal experience and perspective.

Actually I worked for several years in finance and the South Park clip is not wholly unrealistic. I was going to open a run-of-the-mill Triodos Bank ISA account (that’s a UK tax-free savings account where you can invest up to £20K p.a.) but I checked out what they were investing the money in and discovered that they don’t meet my stringent standards of ethical capitalism. Basically, if you want to invest in stocks and shares, that makes you a capitalist, regardless of how many Extinction Rebellion demonstrations you go on. That’s basic Karl Marx for you, whether or not you believe the workers should rise up! Triodos is investing in Danone, a multinational corporation with a history of very dubious business practices, scoring them 4/15 on the Ethical Consumer company profiling system. So forgeddabout Triodos.

The next thing I did was to investigate the Abundance Investments website, where I picked up information on what an “Innovative Finance” ISA is. They do pensions and plain portfolios as well as ISAs. You can see their marketplace where there’s a brief outline about what sort of stuff you can invest in, like renewable energy projects, energy-efficient housing, etc. Of course you come across the “your money is at risk” message, which always makes me wonder exactly how much I could lose and POOF it’s gone! (You did watch that Southpark clip?)

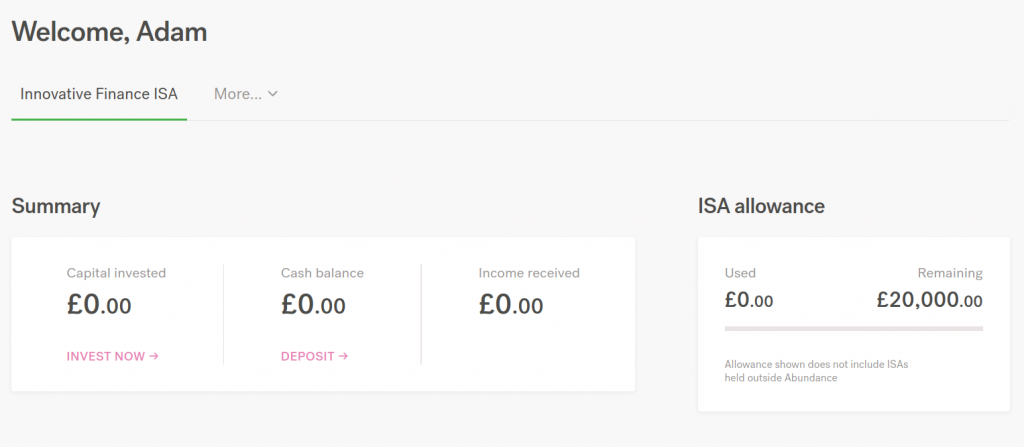

Once you’ve created an account and verified your email address, they promise to get me invested in five minutes – only a few minutes longer than it took the kid in Southpark. Then you have to open an ISA account by clicking on a link titled “MAKE A DEPOSIT OR TRANSFER”. Clicking as instructed gets me to the identity check where they make sure I’m resident in the UK, then comes the bank account number I want to use for withdrawals, then come the terms and conditions, and then I’ve got my account. It’s all well designed with big friendly letters and the £20,000 limit across on the right.

So the Southpark nightmare subsides and I have to put some money in there. I’d love to max out the account with £20K but sadly, I am poor as hell and will probably have to take money back out of my ISA account at some stage before I manage to build up a liveable income doing this. But for now, my cash is going into the ISA. I reserve the right to be unreasonably optimistic that the general public will fall in love with me and shower me with donations – please sign up on Patreon

![]() if that won your sympathy already).

if that won your sympathy already).

Green Investing Red Tape

It takes quite a long time to find the info I need to make a deposit in my new Abundance account, surprising really considering how intensely crafted their website is to get people to do the initial sign-up. My slight obsessive-compulsive disorder kicked in twice here – not surprising since it involves potentially losing £10K. First, Abundance have chosen to keep their cash accounts at Lloyds Bank. This immediately makes me think they’re being sloppy. What’s the point of being all green and sustainable and hugging lots of trees, and then putting your money with a bunch of climate deniers like Lloyds Bank? 3.5 out of 15 on the Ethical Consumer ratings system. Secondly, I notice that my browser says their website is based in the States. Hopefully my money’s not going there too.

Now the money was transferred across and Abundance sent me an automated email on receipt, so I have my tax-free ISA for the tax year. Just to be clear, I am invested to the tune of £10K but the money is sitting in cash in their non-interest-bearing cash pool. Now I have to find something here to put the money in which could generate some sort of return.

At this point, I’m logged into the Abundance platform and I have my £10K ready. Just as I scan where to click next, I realise the website is telling me that the possibility to invest in companies and in councils is “coming soon”. At first I thought this means they don’t have this yet, but I guess it just means that there are currently no new offerings. Investigating, it seems the last one was in autumn 2019.

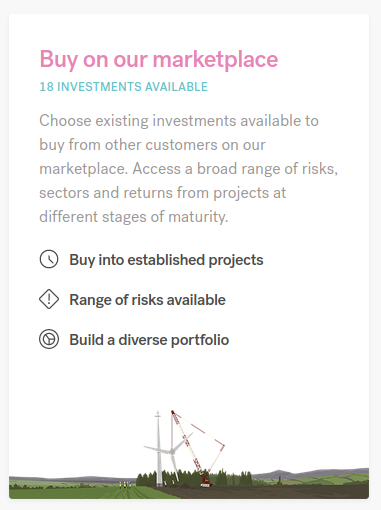

There is a link on this page at the top just below my “Cash Balance: £10K” summary labelled reassuringly “INVEST →”, which reveals the Abundance marketplace, which at this point has 18 investments available, which could be a breeze like buying bike parts on Wiggle, or could be awful like eBay.

The 18 investments are all only available from other Abundance customers. There’s one from a council, another in community housing, one in storage (not defined), transition – also not defined, waste, biomass (woah! BIOMASS??? If you follow my tweets, you’ll know biomass is not kosher, bona-fide, low carbon energy), tidal, wind and so on. They are listed with an investment amount, a reserve price, highest bid and time left – so it must be some sort of bond auction, or equivalent – warrants or deposit notes or some other finance term.

At this point I discover a link to an introduction to the marketplace. Not a second too late. The lack of information so far is the whole reason why I figured it was worth writing this post. I read my way through the introduction in fear of discovering they have a YouTube channel where this is all explained, but there isn’t. And there’s already an Adam in the market – I sense lots of scope for confusion here. Reading the blurb in the Help section gives me the strong impression that they’re very cautious about customer relations. The “Introduction to the Marketplace” section doesn’t enlighten me very much but recommends I get a lawyer. Well at least it’s obviously not a bucket shop. There are also Help sections on how to buy and how to sell, which give a brief run-through of the steps you go through after clicking on an offer. I also discover a useful-looking link to “pricing investments on the marketplace”.

It’s bugging me that they’re still calling these things “investments”. They must think I don’t understand money and will run away screaming if they call it by the correct term. Hopefully all will become clear. Hopefully the investments aren’t junk bonds.

The Important Points

According to the Help guide, the price I’m willing to pay for each investment will depend on the term length, the return and the risks. And it’s GONE! No, wait, wait…

- Term length – so if it has a term length, then it’s going to mature and I’ll be given my money back, so it’s some kind of bond.

- Return – it has a return in %, so it’s paying interest. Like a bond.

- Type of return – it could be fixed or variable rate, interest-only or with capital repayments.

- Risks – of course it also has risks of going “POOF”, so it will have some sort of credit rating and a debenture contract full of small print. There’s no government protection against the companies or councils who issue the bonds going bankrupt and not repaying. Abundance Investments itself does come under FSCS protection, but only for the cash they hold which you haven’t invested – see the FCA website. There will also be a history for each company or council that shows if the payments were made regularly and fully.

Then comes the information you would have to bear in mind such as the national interest rate. If this starts going up, and frankly it is unlikely to go down much further in OECD countries since it is practically zero in 2021, then the return on the instrument doesn’t look so good and its price will go down. But the question, is how quickly interest rates will go up? Pretty much the same problem as you have with a mortgage, except the other way round. Abundance has a whole page on how the national interest rate can affect the money you get back when you sell or when it matures. The risk of interest rate changes going against you are not same as the money going “POOF!”, but they represent a potential annoying loss.

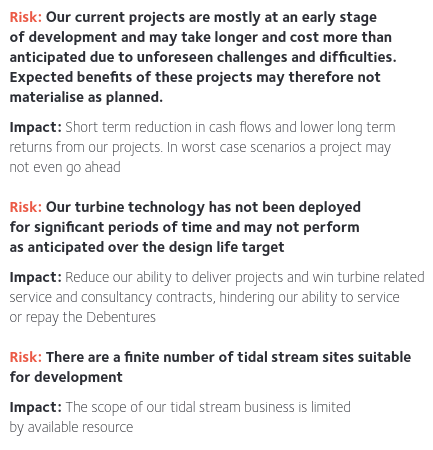

Abundance is now showing me a list of all the “investments” currently up for grabs from other Abundance investors who want to offload. I’m going to call these “investments” “bonds” now because it has 2 less syllables and is far more precise. Actually reading the blurb for the first bond on the list, I see these things are actually called debentures if you want me to be precise. This is from a company called Atlantis Ocean Energy PLC who operate in Scotland. Abundance provides a 500 word blurb “About” section, some “News” which looks like payment bulletins and links to 2 PDFs, one of which is a factsheet and the online equivalent of a glossy brochure, and the other a 20-page legal document full of small print. The factsheet usefully includes 2 pages on the risks – outlining about 20 risks in all, which is enough to get my toes curling.

The Risks

Reading all the risks that the company declares in its factsheet is a real downer. Things like not being able to find suitable sites, not being able to raise additional capital, changing regulatory climate and so on all seem individually manageable but 20 of them all at once is a bit of a slap in the face. Looking for some re-assurance for my risk-averse inner scrooge, I just discovered Abundance has flagged the Atlantis Ocean Energy logo graphic with a symbol in the top left corner. It’s that green “ON TRACK” here – and when it’s not “on track”, it can be “late payment”, “in default” (POOF), “restructured” or “material change”. Any of those states could be triggered by one of those 20 risks actually happening. The flag isn’t really telling me the risks though, it’s telling me what happened already.

So at this point I could panic at the risks and stuff my money back under the mattress, or go online and search for “Abundance and it’s gone“, or just sleep on it and decide tomorrow. Actually I think I’m going to do that online search and sleep on it. These snapshots are from the factsheet.

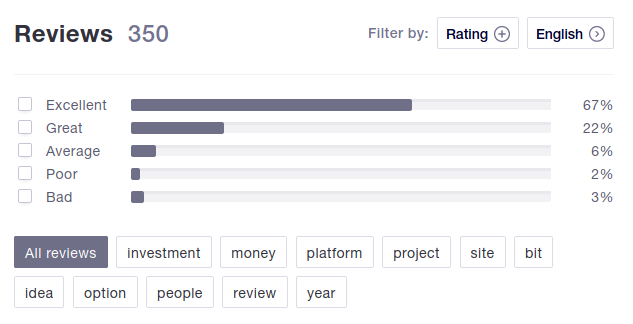

It turns out that Trust Pilot has 350 reviews on Abundance, most of them rating it as ‘Excellent’. The first complaint seems to be that these are illiquid – in other words, it’s not a big marketplace and you might not be able to sell the bonds if you want to get out. In my case, I am investing my ISA money that is intended for my retirement. Although I said at the start I might want to withdraw my money again if times get hard, I have other ISA accounts with cash so I’d have to take that first before trying to liquidate any Abundance investments I make. Then the rest of the complaints that I find as soon as I switch into my favourite viewing mode – filtering on the “bad” reviews only – are all from people who lost money, surprise, surprise. Nothing like firing off a stinking review to help soothe the pain of losing money.

To be clear, if I invest in Atlantis Ocean Energy and it all goes badly wrong, the money’s gone. It might not all be gone. You might lose only some of the investment. As a bond holder though, you have more rights than you would have if you’d just bought shares on the stock market. Lots of the complaints on Trust Pilot are from people not understanding what just happened when they were told about a “restructuring” or “defaulting” by the company whose bonds they hold. But how likely are these things? Abundance aren’t telling although I’ve fired off an email to their support desk to see if they’ll reveal all. One reviewer on Trust Pilot says that 2 out of 15 of his investments lost money, but that’s just one investor, not the average.

There is a correlation between how risky the debentures are deemed and the interest rate they are offering at the initial sale. The safer the investment, the lower the interest rate, or rather, the closer the interest rate is to the current rate from building societies. Reading the replies from Abundance on Trust Pilot, the interest rates can be from 4.5% (safe) to 15% (risky), but that’s just my conclusion and there are probably other factors involved too. Needless to say, I’ll stick to the low interest rate offers.

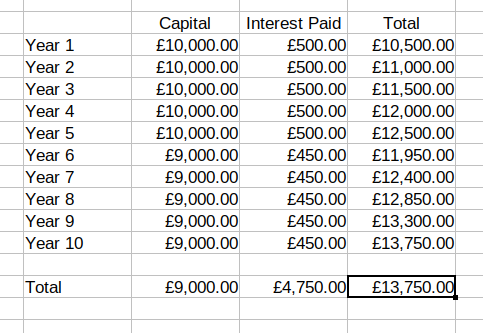

If I had a lot of cash to spread around, I could employ a bit of “diversification” to lower my risks, by investing in 10 or 15 different companies. For kicks, let’s do a quick back of an envelope calculation. If I diversify across 10 different debentures at £1,000 each, managed to get an average of 5% interest across all of them, and 1 out of 10 of them went POOF after 5 years, this is how it looks:

If that makes sense, then you understand you still come away with £13,750 after 10 years, despite one of your investments going POOF. If you have a maths brain, you will immediately see how you could reinvest the interest payments to compound the interest. But rather than dreaming of the denari you could earn, best consider that you would still be OK if 3 of your picks went totally belly-up. The likelihood that I can see is that only one in ten will totally default, and 1 or 2 will be restructured, meaning you get your money back but not as much interest as you’d planned. Of course we could have a repeat of the Great Depression and all of them sink without trace, but I’m just trying to be realistic.

The biggest thing that worries me in actual fact is the UK government, who just did a U-turn on their Green Homes Grant causing aggravation and financial damage to firms across the country. Nothing is going to prevent them from doing the same thing with policies affecting any of the investments on this platform. That is of course one of the risks listed in the factsheet.

The prudent reader would also have noticed from my back of an envelope calculation that I also assumed I’d get the bonds at face value at the initial offering. I do not know – Abundance hasn’t replied to my email. The one new offering that I have seen was not an auction, but that doesn’t mean they will all be like that. It may be an auction, in which case foolish people might pay far more than face value, and that would reduce the IRR (the effective interest rate I get on what I paid for the bonds).

My last point on risk which I’ll put to Abundance if they communicate, is that they claim to offer “a range of risks”, but they don’t explain anywhere how to judge the severity of the risk. It might be simply reflected in the initial interest rate on the bonds, but I’m not sure if that is even half the story.

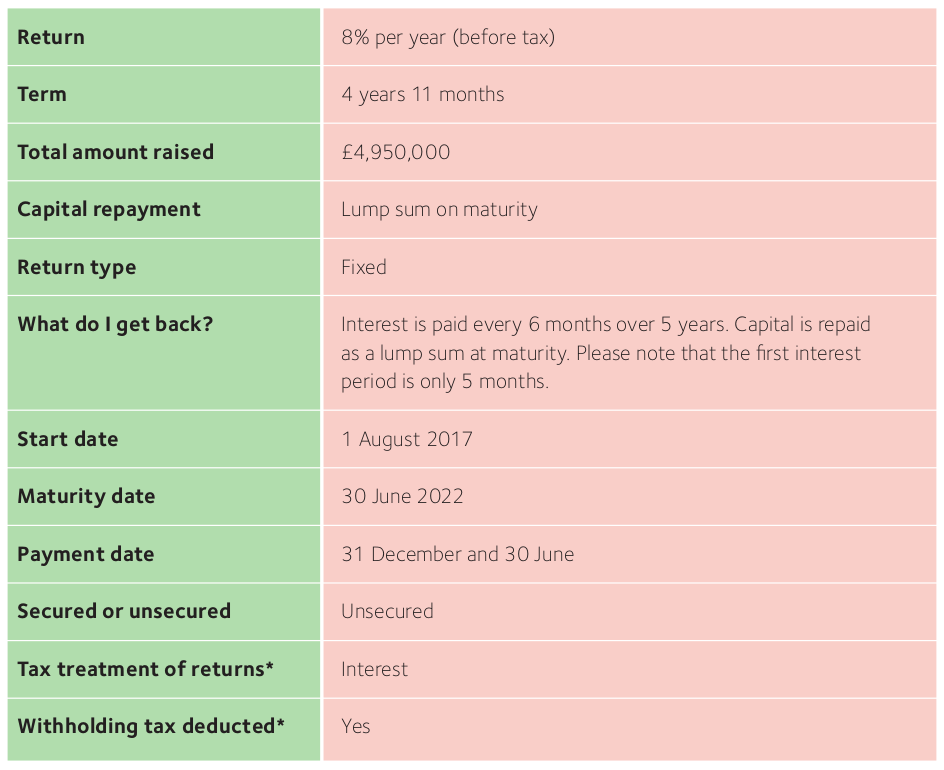

But for this humble example, let’s just look at one, the Atlantis Ocean Energy offering. These bonds have paid out regularly for the past 4 years, there are no red flags in the initial offering factsheet and risk list, and this company has issued bonds on Abundance before. On the downside though, the nominal interest rate (at the initial offering) was 8%, which is nice but is therefore riskier, and the company isn’t big enough to have a credit rating from any of the biggest ratings agencies. On balance I think it’s not too risky.

What Price?

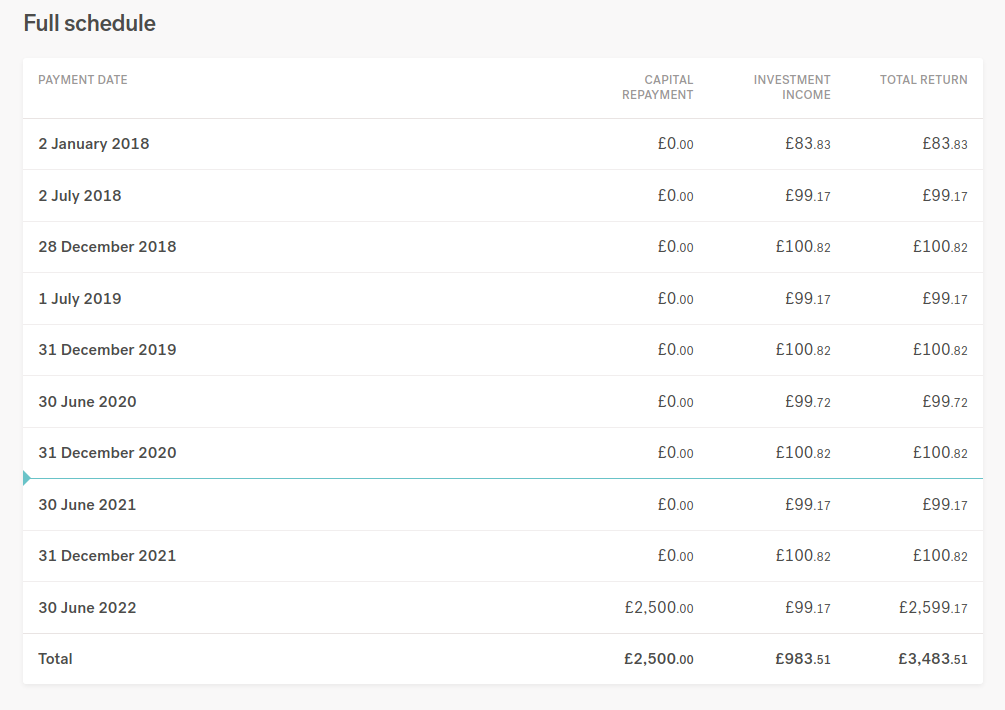

Now I have to work out how much I should bid to buy some. The “Full Schedule” table below shows the payments history and the thin blue line just beneath December 2020 separates past payments from future payments. The future payments are the interesting ones.

The current owners are certainly not going to sell them at face value if the bond’s paying a really good interest rate, they’ll be demanding more. And vice-versa for the instruments with poor rates (like zero %, for instance) – they might sell it for less. In fact these Atlantis bonds are easier to understand because of the way the bond is structured. It pays the interest every 6 months and then on maturity, it pays you back the capital invested. There’s no gradual capital repayment to take into account. The interest payments under the investment income header vary because they’re calculated per day so number of days in the month and leap days come into play. Not that it matters – you don’t have to do much arithmetic yourself because Abundance provides an interest rate calculator on the same page so you can see the return.

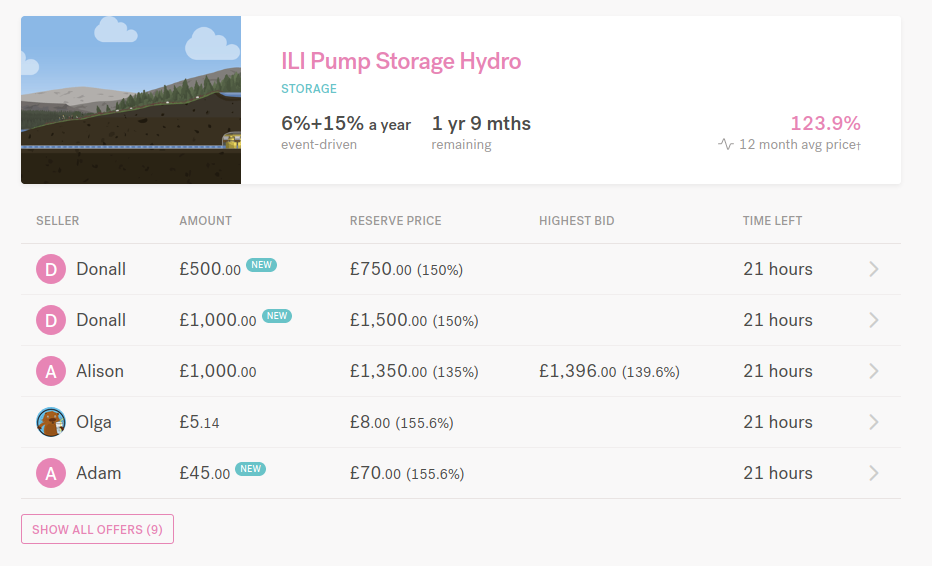

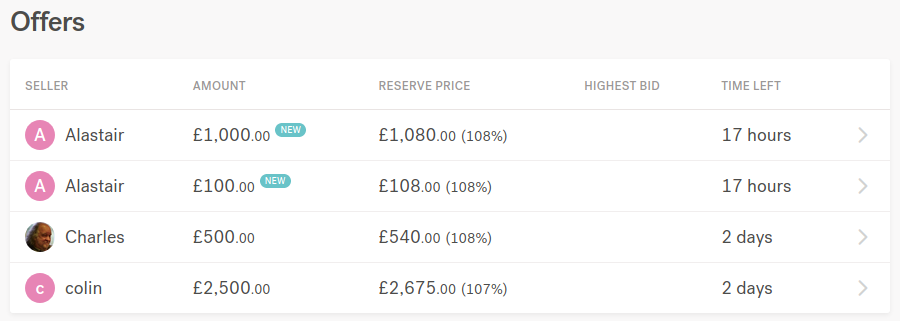

These are the current offers. I’ll probably watch them for a couple of weeks before bidding to see how they vary. They are quite short-lived – these offers will be bought up (or expire unsold) after a couple of days.

It seems to me at first glance that the larger amounts can get you a better return. It’ll be worth hanging around to verify that assumption. I won’t be able to bid lower than the reserve price and Abundance show the % in brackets there so it’s easy to compare the offers’ reserve prices despite the different amounts. What would be more useful would be the simple interest rate that reserve price would get you. Clicking on one of the offers gets me to another page where I can see if anyone else is bidding and where there’s the interest rate calculator where I can enter the bid I’m thinking of and see what rate that brings.

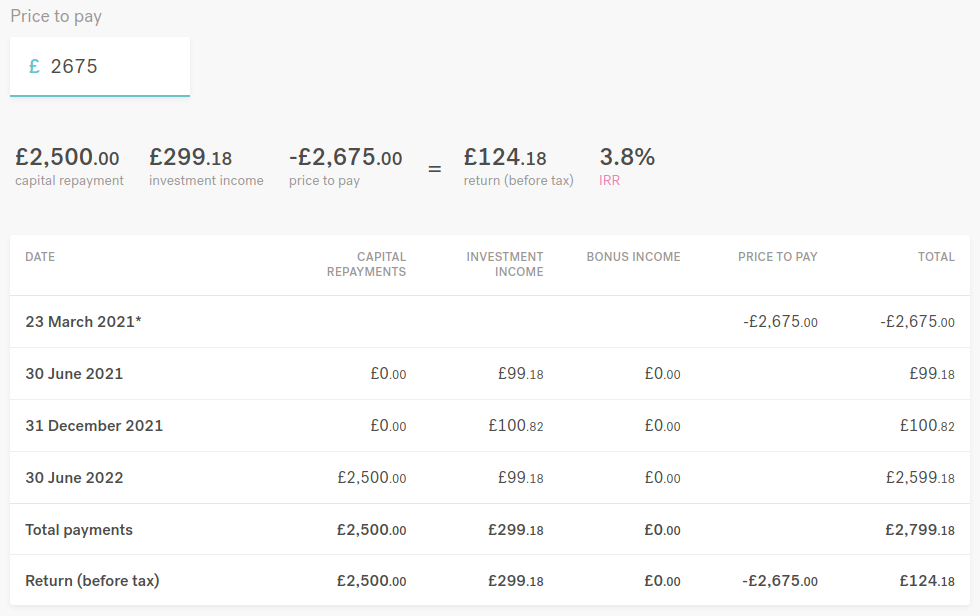

I plugged in this seller’s reserve price the £2,500 bond (£2,675) and it gives the rate of return (IRR in the screenshot) as 3.8%. Now if your inner caveman is thinking “why on earth would I pay this seller £2,675 for his £2,500?” then you are just like me. But obviously the seller cares not a damn for your inner caveman feelings, since that shrewd investor knows you’re unlikely to get an offer like this at your building society. So my thirst for filthy lucre overcomes my inner caveman – this is run-of-the-mill bond investing. After some more deliberation and I decide to invest £2,675 in Atlantis Ocean Energy, despite the fact that they got it for face value with 8% interest fixed rate. That rate on offer when it was originally issued – the “coupon” – is given as basic information, as in the screenshot 5 shots above. That’s why the interest payment every 6 months is roughly £100.

With the rest of my cash, I will wait for an offering. But with that £2,675 investment, I know I’ll be getting 3.8% as long as I don’t sell it before mid-2022 and then it’ll mature and I’ll get my money back. The risk that something goes seriously wrong in the next 18 months is low and the Atlantis Ocean Energy has a good track record.

New Offerings

With immaculate timing, I just received an email from Abundance Investments announcing a new offering. It’s from Northern Gas Networks Ltd, who own the underground gas pipe network in Northern England. The headline blurb says they want money for converting their pipelines for use of hydrogen (H2 – what they had in the Hindenburg Zeppelin that burnt up spectacularly) instead of methane (North Sea gas) – there’s a problem with that, but first, this is the offer:

- they are aiming to raise £1 million

- the threshold for the sale is £300K (or it is withdrawn)

- the minimum investment is £5

- the interest rate is 1.6% fixed

- it’s a 10 year term, interest-only repayments

- the company has a BBB+ credit rating from Standard & Poor’s credit rating agency

- their whole investment program is £500 million, so this is a fraction of that

The hydrogen business concerns me. It is not a done deal that the UK is going to convert from North Sea gas to hydrogen. Reading the offer document (glossy brochure PDF) I see that the work they do replacing pipes is probably going to massively reduce the amount of methane leakages they suffer, so even without hydrogen, this work will have a large impact on their carbon footprint. They bandy the “Net Zero” term around, which they shouldn’t because it is meaningless (more on that in another post) and they only mention in passing that hydrogen might not actually be “green” at all, because you can create your hydrogen through processes fuelled by fossil fuels if you so wish. But regardless, due to its methane leak fixes, it is green anyway.

They do a very swish job on their factsheet/offer document. There’s a lot of meaningless buzzword bingo going on to show off their green credentials. The risks all look realistic though. There are a couple of things that irk me, such as the holding company being registered in the Bahamas and the cleverly constructed corporate structure consisting of 10 separately registered companies. This is annoying because it’s all typical capitalist profit-beats-ethics behaviour, and it also betrays the fact that they will no doubt drive a very hard bargain with us bond-holders if they do hit problems and need to restructure. They will obviously have some very well-paid lawyers from Lewis-Sillitoe-Piranha & Partners. Lastly there is the small question of why they are raising £1 million when all they talk about in the offer document is the £500 million they are going to need.

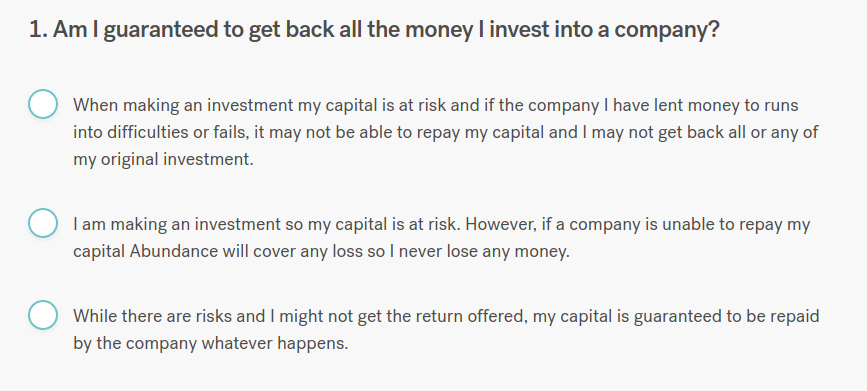

To actually invest, I have to check a box saying I’ve read the offer document small print, and then answer a questionnaire to prove it:

On question (2) on the option that I have to choose as the right one, it gives some information I was looking for earlier: “Investments with a higher return are usually correlated with higher risks.” So this offering is at the bottom end of the risk scale. Fair enough. Then on question (4) they provide the information about diversification as one of the answers which I mentioned earlier. This is a seriously round-about way of giving advice, no doubt because Abundance Investments are not allowed by the UK FCA regulators to give advice.

I can bail out of the investment early, if I really want cash again, using the same Abundance market place, as long as there is a buyer – which isn’t guaranteed. But if interest rates go up, I wouldn’t get the same price for the bond, because the remaining repayments would be comparatively less attractive than what people might get for their money with other new bonds being issued with better rates.

So there you have it. Investing in bonds in green companies and government projects can get pretty good interest rates. It’s fun looking at the low carbon or renewable energy possibilities out there and knowing the investment isn’t going to finance coal mining or anti-personnel mines or any other type of unethical business. There’s a bit of a risk involved and Abundance doesn’t offer a complete overview of all investments they’ve ever offered and how many had problems which impacted the investors, so hmmm, I’m not totally happy with it. However if you decided instead to go with a fund instead where a manager takes all the risk and your investments just fluctuate with the general market and with only a minimal risk of loss, perhaps even guaranteed by the FSA, you will pay for that somehow in the form of lower returns in the long run. The fund manager takes a cut, that’s for sure, and that comes off the returns you get. Plus as I mentioned, the fund manager might be investing in Danone or other dubious multinationals despite the fund’s advertised intentions.

Hopefully as society tackles global warming and climate change, the great energy transition away from fossil fuels will become a reality and these sort of investments will become more and more common place.

One reply on “Green Investing with an Abundance ISA”

Bad green bonds. Like gangreen bonds

https://www.bloomberg.com/news/articles/2021-03-29/bond-investor-revolt-brews-over-bogus-green-debt-flooding-market