A carbon price is the key factor that business, industry and the economy need for a swift and efficient energy transition. But what kind of carbon price do the carbon markets currently create?

This is all hugely overcomplicated. Too many factors affect the price of credits on too many different markets. We need a universal carbon pricing mechanism to generate a robust, strong carbon price signal. EcoCore advocates for carbon accounts – read the manifesto PDF

- Establishing a carbon price is one of the top recommendations from economists to tackle the climate crisis. The price signal guides business to the lowest cost climate solutions.

- In countries with a state-based emissions trading scheme, the price is set initially at auction

- In countries with a carbon tax, the state sets the price directly

- Otherwise the voluntary carbon markets rely on buyers and sellers to make the price, based on the following variable factors & measures

- Scroll for examples.

| Factor | Detail |

|---|---|

| Data Procedures (MRV) | Base-lining, monitoring, reporting, verification specifics |

| Exclusivity / Uniqueness | Avoidance of double-counting of project in multiple jurisdictions |

| Additionality | Emissions reductions a direct result of project, not incidental |

| Permanence / Reversibility | Risk of captured CO2 being lost back to atmosphere |

| Leakage | Risk of CO2 emissions activity being re-located not stopped |

| Ethics, Co-benefits, Harm | Respects communities, biodiversity, and local ecosystems |

| Transparency | Recorded in transparent, independent, public registry |

| Market mechanics | Market liquidity, bidding and settlement influences |

CO2 Emissions Data Quality

| Detail | Description |

|---|---|

| Baseline setting | Establishing a credible, scientifically rigorous emissions scenario with local, compatible data on which to base actual emissions reductions |

| Monitoring | Effective measurement of emissions |

| Reporting | Regular reporting to designated third party organisation |

| Verification | Regular checks on validity of all of the above by third party independent organisation |

| Example | A low quality carbon project would claim unrealistically high regional deforestation rates, overestimating the baseline that the project’s impact is measured against |

| Example | A project’s carbon credits would be valued less if the project has no independent verification of the emissions reductions it claims |

Exclusivity or Uniqueness

| Detail | Description |

|---|---|

| Consideration | The emissions from a project should only count once across all markets, time-frames and boundaries. |

| Risk | Double-counting: the carbon credits from a project are effectively sold twice or more times. This erodes trust in the project, reduces the number of willing buyers, impacts the price achieved and discourages investment in similar projects. |

| Example | The fossil fuel emissions avoided by a renewable energy project in a certain nation are sold to a corporation but are also used by the nation to count towards its national climate targets with the UNFCCC. |

| Example | A carbon credit project provides emissions reductions for a state’s emissions trading scheme, but also sells the carbon credits on the voluntary carbon market to a private corporation. |

Additionality

| Detail | Description |

|---|---|

| Consideration | Would the CO2 reduction happen, even if the project did not occur? |

| Risk | If a carbon credits project is initiated but has additionality problems, i.e. the CO2 reductions promised will occur anyway, then the credits do not actually represent CO2 emissions reduction. The carbon price will be reduced as fewer participants are willing to buy. |

| Example | A hydro-power project in a region where hydro-power is the cheapest option cannot earn high quality credits for displacing a fossil fuel power-station which would never have been built. |

| Example | Methane capture at landfills could earn carbon credits, but when the local landfill regulations stipulate methane capture systems anyway, the issuer could only generate low quality credits |

| Example | A steel mill installing more energy-efficient equipment could not issue high quality credits if the upgrade would pay for itself through energy savings even without carbon credits |

Permanence (Reversibility)

| Detail | Description |

|---|---|

| Consideration | Durability: CO2 emissions reductions are permanent |

| Risk | Captured CO2 could be lost back into the atmosphere. Carbon credit purchasers would consider their credits devalued or worthless. |

| Example | Geological carbon storage (mineralisation) and biochar lock away the CO2 for centuries or more |

| Example | Forests can burn, peatland can be degraded |

| Example | Tree-planting projects by inexperienced operators can result in 100% failure of trees to reach maturity |

| Example | Soil carbon projects without safeguards against land-use change can result in the land losing all sequestered carbon |

Leakage

| Detail | Description |

|---|---|

| Risk | CO2 emissions activity may be re-located, not stopped. Fewer buyers would come forward as the promised CO2 emissions reductions did not actually occur. This results in lower prices, if the credits can still be sold. |

| Example | Forest protection projects in otherwise unprotected forest regions will only displace logging into adjacent areas. High quality credits would need to demonstrate wider levels of protection. |

| Example | If putting land under protection prevents local people from farming, they will be forced to farm in other areas which will then suffer. The result is no net emissions reduction. |

| Example | A livestock farm captures methane from manure and sells carbon credits. If it makes the farming more profitable, this will lead to an inevitable increase in farms and farm sizes and the additional emissions could negate those captured. |

| Example | A hydro-power project claims carbon credits for avoiding fossil fuel power generation. The dam floods a large forested area and causes massive methane emissions from decomposing organic matter. |

Ethics, Co-Benefits and Harm

| Detail | Description |

|---|---|

| Consideration | Respects communities, human rights, biodiversity, and local ecosystems |

| Risk | Impacts local communities, causes displacement or land conflicts, impacts biodiversity conservation efforts |

| Example | A large-scale afforestation project that makes use of mono-cultures of non-native tree species will damage local biodiversity levels |

| Example | “Land grabs” often occur where local people are forced off land to allow carbon credits project to operate, especially in less developed nations where the local people have little or no access to legal protections |

| Example | Local populations e.g. villagers and farmers, can be tricked into giving up rights to land and resources in return for comparatively large sums of money from the carbon credit income that is never actually forthcoming |

| Example | When a carbon project verification agency is owned by the carbon exchange selling the carbon credits, a conflict of interest arises because the carbon exchange has financial incentives to ignore its verification standards in order to sell more credits. |

Transparency

| Detail | Description |

|---|---|

| Consideration | Carbon credit projects need to be recorded in transparent, independent, public registries |

| Risk | Lack of clear information, accountability or proper disclosure raises legitimate concerns |

| Example | A rainforest conservation project not publicly disclosing its baseline deforestation rates or its monitoring methodology makes rigorous verification impossible |

| Example | A wind farm in a country with an authoritarian regime avoids undergoing external audits by foreign auditors. Self-reporting of emissions avoided cannot be verified. |

| Example | A mangrove restoration project sells credits to multiple buyers multiple times with no clear accounting provided. The total carbon credits on the market add up to more than the CO2 sequestered. |

| Example | A carbon credit registry which does not allow public scrutiny of project details or credit retirements makes it very difficult to validate true rates of CO2 emissions reduction or sequestration. |

Market Mechanics

| Detail | Description |

|---|---|

| Market liquidity | Liquid markets allow participants to buy and sell with ease at prices close to the quoted price. Illiquid markets tend to result in poor prices and uncertainty with lengthy delays for trade execution. |

| Bidding | Prices are primarily set by the bids and offers from market participants looking to buy or sell carbon credits. |

| Settlement | Price means nothing unless an agreed trade is actually settled at the price agreed between the buyer and the seller, and each has their account adjusted accordingly. |

| Carbon Exchange | The market operators, i.e. the carbon exchanges, generally put great store by their ability to guarantee the execution and settlement of trades for their participants. They compete with other exchanges to publish the most reliable and timely price data. |

Sources

Turner G., Grocott H., Maslin M. et al: The Global Voluntary Carbon Market – Dealing with the problem of historic credits Trove Research Report (2020)

Schwartzman S.S., Lubowski R.N., Pacala S.W. et al: Environmental integrity of emissions reductions depends on scale and systemic changes, not sector of origin Environ. Res. Lett. 16 091001 (2021)

More in this Series

The voluntary carbon markets are estimated to have a turnover in 2022 in the order of US$ 2 billion. Current estimates…

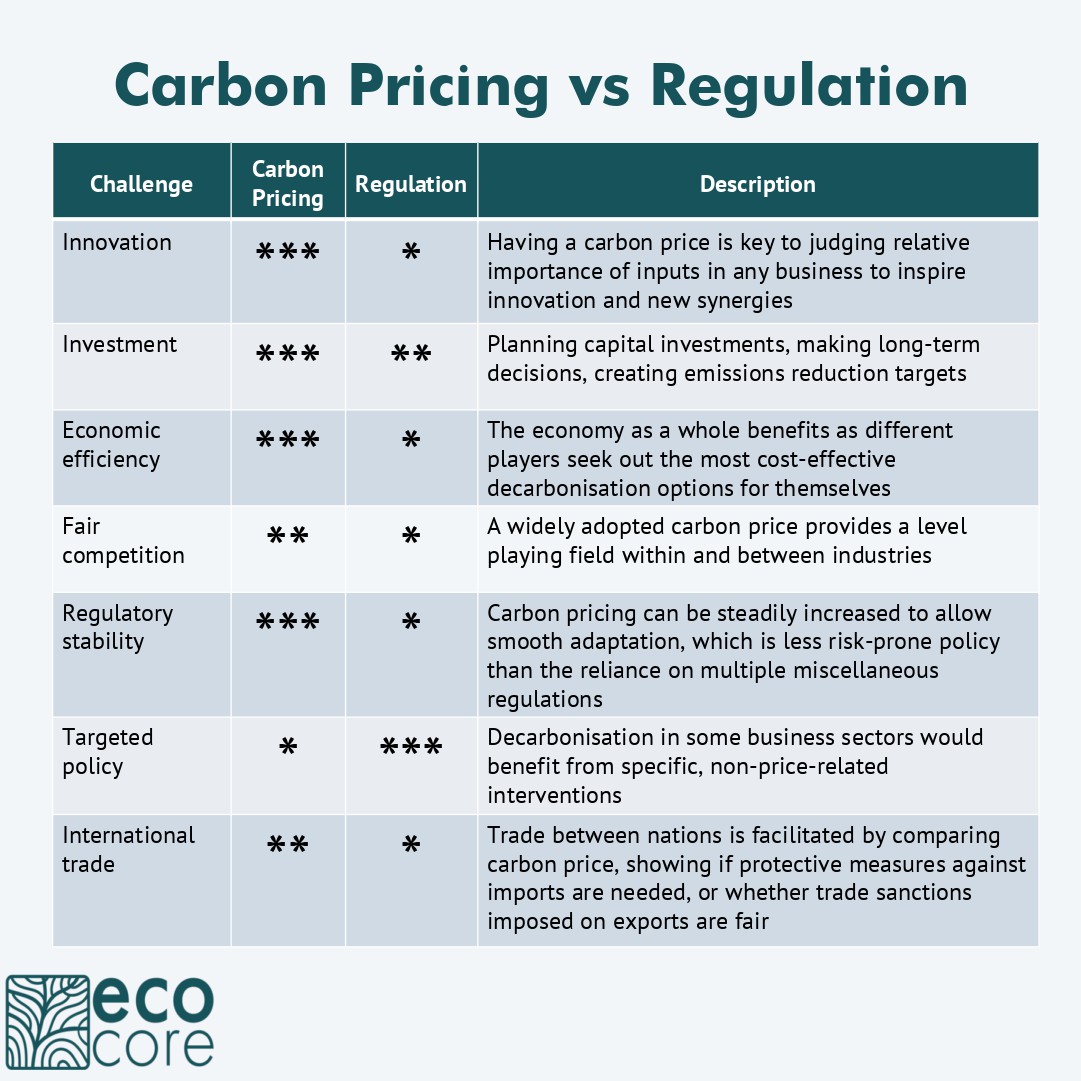

Carbon pricing: what is it? Essentially it is just information about money – the price signal, which you need if you…

The de facto industry standard for reporting CO2 is the GHG Protocol, with its omnipresent Scope 3 emissions. See the table…

Despite decades of carbon trading, CO2 emissions continue to rise, and it seems little can improve the carbon markets. The impact…

EcoCore’s hypothesis is that our Carbon Accounts framework would create the strongest carbon pricing signal above any other approach to drive…