Carbon pricing: what is it? Essentially it is just information about money – the price signal, which you need if you wish to sell at a high price, or buy at a low one. Businesses of course, but people too, need this information to make decisions to buy or not, and at such a low visceral level in their decision-making that we are hardly aware of it. Pricing anything is subconscious activity that takes a split second when the information is available and in the right format.

Carbon pricing can take several forms, but they are almost always brought about by government, alongside other climate policy.

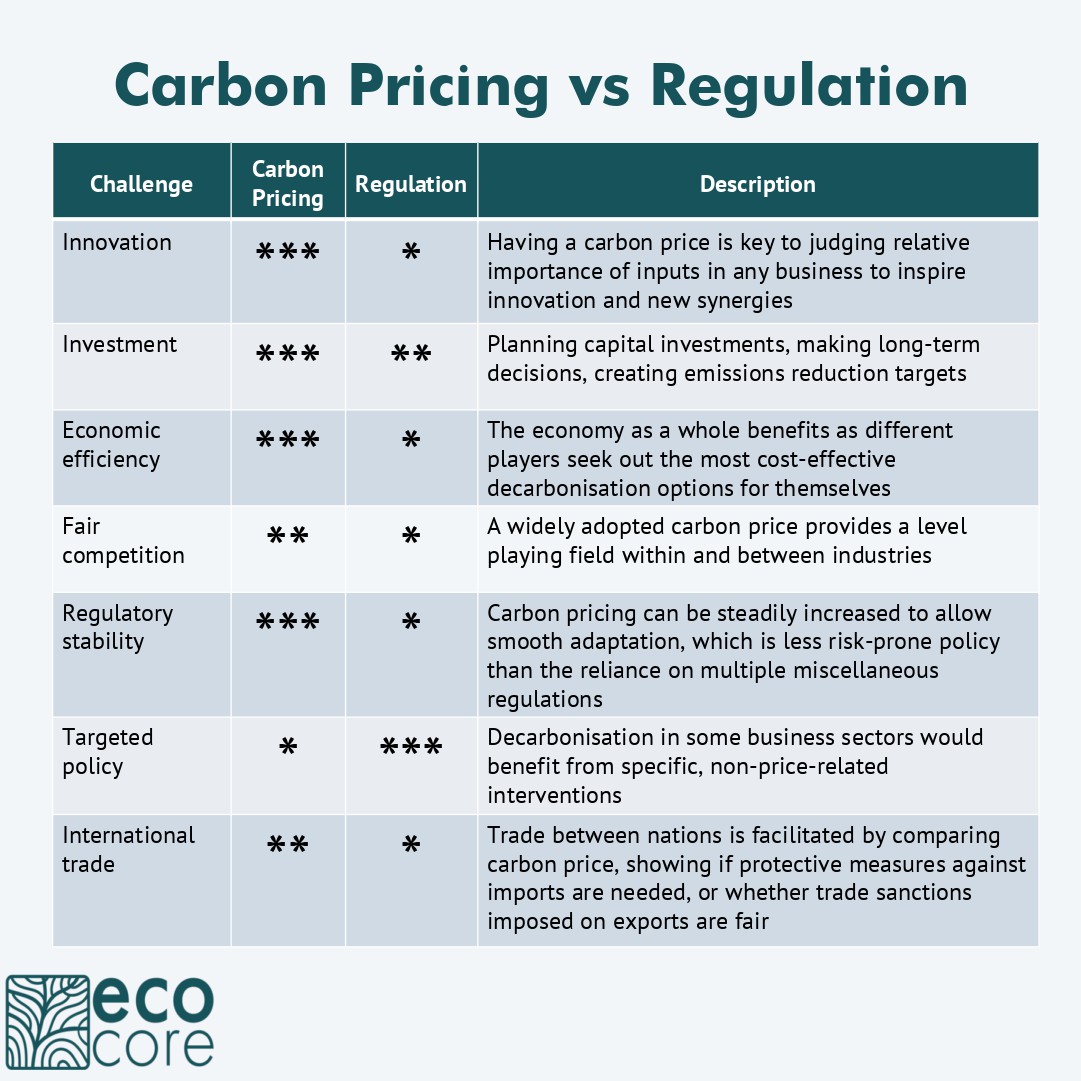

Direct business intervention though is the first port of call when a government wants to intervene to accelerate the energy transition, which we’ll call plain old ‘regulation’, but economists generally prefer a carbon price.

For economists and business decision-makers, a carbon price makes information about emissions available in terms of money – the price signal. It requires minimal business acumen to buy the lowest priced goods or services. People in domestic life also benefit from the information.

Carbon Accounts Generates Carbon Pricing

EcoCore’s carbon accounts policy creates the market for carbon tokens that then creates a carbon price, and our claim is that this is the strongest price signal possible, since it would contain the maximum number of participants possible compared to other frameworks, including all citizens, businesses, industries and branches of government. Find out more about how it works in our manifesto.

This framework [carbon accounts based on carbon allowances] should replace attempts to set an artificial carbon price. We roughly know the quantity for various global warming scenarios. Setting the quantity per capita & issuing that could be a lot more effective than trying to guess the “right” price for carbon.

Prof. Steve Keen, Co-author and Winner of the Revere Award for Economics (2010), awarded for being one of the few economists to predict the Global Financial Crisis and for his pioneering work in dynamic economic modelling

| Challenge | Carbon Pricing | Regulation | Description |

|---|---|---|---|

| Innovation | *** | * | Having a carbon price is key to judging relative importance of inputs in any business to inspire innovation and new synergies |

| Investment | *** | ** | Planning capital investments, making long-term decisions, creating emissions reduction targets |

| Economic efficiency | *** | * | The economy as a whole benefits as different players seek out the most cost-effective decarbonisation options for themselves |

| Fair competition | ** | * | A widely adopted carbon price provides a level playing field within and between industries |

| Regulatory stability | *** | * | Carbon pricing can be steadily increased to allow smooth adaptation, which is less risk-prone policy than the reliance on multiple miscellaneous regulations |

| Targeted policy | * | *** | Decarbonisation in some business sectors would benefit from specific, non-price-related interventions |

| International trade | ** | * | Trade between nations is facilitated by comparing carbon price, showing if protective measures against imports are needed, or whether trade sanctions imposed on exports are fair |

More in this Series

The voluntary carbon markets are estimated to have a turnover in 2022 in the order of US$ 2 billion. Current estimates…

The de facto industry standard for reporting CO2 is the GHG Protocol, with its omnipresent Scope 3 emissions. See the table…

A carbon price is the key factor that business, industry and the economy need for a swift and efficient energy transition.…

Despite decades of carbon trading, CO2 emissions continue to rise, and it seems little can improve the carbon markets. The impact…

EcoCore’s hypothesis is that our Carbon Accounts framework would create the strongest carbon pricing signal above any other approach to drive…