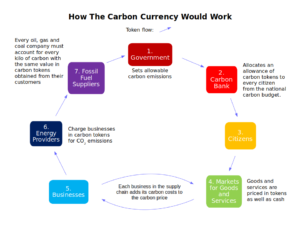

It is now vital that government action on climate change and emissions reduction is rapid and far-reaching. No one policy can be successful on its own at this late stage. What is presented here is a new framework combining other policies, which together provide a robust approach that brings:

- allocation to all citizens of a carbon allowance in the form of tokens from the national carbon budget

- complete coverage for payment of the carbon price on every product and service in the economy

- a nation-wide dual currency system of cash and carbon tokens implemented through the supply chains of every sector in the economy

- control of the supply of fossil fuels at the point of extraction, enabled by collection and surrender of carbon tokens by the fossil fuel producers

- innovation-driving, systemically transformational effects on industry and commerce

The policy is a paradigm shift from the slow, incremental and piecemeal approach of the Net Zero 2050 policies. It offers ordinary citizens a key role in the fight against climate change and a share of the responsibility for achieving the Paris 1.5°C target.

- What is the case for carbon allowances?

- The Policy Concept

- Infrastructure to implement the policy

- How we can implement the policy

- Advantages of this approach

- Comparison with other approaches

- More on Carbon Allowances

- Appendix 1: Previously Known As

- Appendix 2: Example of Carbon Tokens Usage in Business

- Appendix 3: Methane Control under the Carbon Allowances System

- Appendix 4: Preservation of Natural Carbon Sinks and Prospects for Carbon Drawdown

- Appendix 5: More Robust Future Carbon Offsetting and Voluntary Carbon Markets

What is the case for carbon allowances?

Climate science quantifies the amount of CO2 emissions allowable under various emissions scenarios, so we know what is required to stay below 1.5°C. This is a dramatic crossroads for humanity, as outlined by the UN IPCC‘s 2022 report: without concerted, rapid and unprecedented efforts to reduce CO2 emissions, we have no chance of keeping to 1.5°C. That is the temperature rise considered by climate scientists and the most affected nations as the limit for continued human civilisation with manageable consequences. Hitting 2.0°C of global warming is “highly undesirable” – scientist-speak for really bad.

The world’s current approach to climate change will see us hit close to 3.0°C[1]Climate Action Tracker on government climate promises’ credibility gap. This will bring global economic recessions along with damage and adaptation costs high enough to threaten democracy. It’s likely to induce governments to shut down the fossil fuel industry in short order to limit further losses, regardless of the drastic, disorganised impact on the economy and society.

It’s not just conspiracy theorists who predict the introduction of energy rationing: it’s considered inevitable by 50% of people in a global 2022 survey[2]The European Investment Bank 2022 climate survey: citizens call for green recovery: calls for a green recovery.

So we know what CO2 emissions we must keep to if we want to stabilise the climate, the economy, our social infrastructure: we should divide that total fairly to give every citizen a carbon allowance to spend on CO2-emitting products and services. A new currency based on these allowances would be far superior to ordinary rationing with its coupons for a flight, meat, or fuel – it would show the carbon price for every product and service, something business and commerce have been demanding for years.

This is important and transformational because a new carbon currency simplifies the whole approach to the great energy transition we so urgently need. The Bank of England has issued clear warnings to the finance sector that our current systems won’t otherwise survive[3]“The current economic systems will not cope” says the Bank of England. Secondly, policy-making would be much simpler. As things stand, there is a clear risk of governments being overwhelmed by the challenge (“decision lag”)[4]See the University of Exeter‘s work on the energy policy needed to deliver Net Zero.

For our society and citizens, the benefits of a comprehensive carbon currency would be even greater. Managing a personal carbon allowance will turn us all into CO2 emissions experts as it becomes part of everyday life. The way that people’s CO2 emissions are hugely dependent on their income would mean that the majority of us would be able to sell our unused allowance for cash while those who are the most profligate “high burners” seek ways of making their carbon-intense lifestyles more sustainable, or are compelled to buy more tokens.

The carbon tokens in the allowance directly represent how much CO2 the nation can emit – they add up to the total national carbon budget. The fossil fuel companies’ role is to require payment of the tokens on all their sales, which brings about the end result of steadily reducing national CO2 emissions.

The Policy Concept

Government takes the lead…

The UK Committee on Climate Change produced an extensive and wide-ranging document[5]UK Committee on Climate Change: Net Zero 2050 Strategy UKCCC outlining a policy path to steer the world’s sixth largest economy to net zero CO2 emissions by 2050. There are two problems:

- were their recommendations plausible?[6]UK Parliament Commons Select Committee 2019: Government’s target for ‘net-zero’ by 2050 undeliverable unless clean growth policies introduced (UK Parliament)

- what indicators should be used to balance and prioritise research, development and investment across all these facets of the economy?[7]Workman, M. et al, 2020: Decision making in contexts of deep uncertainty – An alternative approach for long-term climate policy Science Direct

The CCC strategy is an eclectic, wide-ranging collection of recommendations which has to stretch across multiple different industries, business sectors and citizen behaviours. Our carbon allowances policy would allow decision-makers to focus on the quantity of emissions to allow, rather than how to achieve those emissions cuts in such a variety of sectors. Since governance would predictably require less time and resources once the monetary infrastructure for the carbon currency is in place, the policy and regulatory power of government could then be focused on accelerating desirable developments and managing undesirable ones.

…and individuals hold the power

The concept of a carbon allowance is similar to rationing, which is categorised by economists as a fundamentally progressive fiscal policy – in other words, it is fair and seen to be so. Studies looking at rationing in the 1940s and 1950s are illuminating.

In this system, the carbon allowance would be paid regularly via a personal carbon account. (Children and teenagers would receive a percentage of the adult quota). A certain percentage of citizens’ allowances would be taken off at source like a tax, to pay the carbon costs of running public services and to prevent anybody being unfairly affected by the system if they are in extra need of carbon tokens through no fault of their own.

To reduce CO2 emissions to zero, the first allowance period would begin by allocating enough carbon tokens to cover society’s existing emissions. At the individual level, this would only impact those with an above-average carbon footprint. Read more on the first day of implementation. The allocation then steadily reduces over time. Reduction might need to be stepped up in circumstances of accelerating climatic instability, or the allowance might be temporarily increased to stave off exceptional social or economic damage, but always with the guarantee that due to supply restrictions, the amount of carbon tokens allocated would cap the CO2 emissions produced.

Both citizens and business people would quickly learn to handle their carbon tokens in the same way as money. The system allows individuals to make their own decisions on where to make carbon savings – they have the choice, hold the power and define the direction the energy transition takes. Few would be forced to cut down in all areas of consumption at the start, most could make savings where convenient in their lives, favouring the lowest carbon prices, and maximising their own welfare, with no mandatory state controls on flights, meat, transport or other personal choices. This applies to business and public services as well as individual citizens.

Key to the system and how it generates the carbon price for products and services is the rule that businesses, commerce and industry do not receive an allowance of carbon tokens: individual citizens exercise their own choices in the market for products and services, and their willingness or not to pay any given carbon price is the ultimate feedback in the process.

The incentive for business

Business ultimately plays by a set of rules defined in law and is typically concerned only with profit and loss brought about by its actions in that context. For business therefore, the carbon currency is basic: it makes going green part of the rules, even while recognised as being fair to all involved.

Under the dual currency system, businesses must charge customers carbon tokens as well as money for all products and services, which they then need to manage prudently to cover their own carbon expenditure, since they receive no carbon expenditure of their own.

The businesses use their carbon token income to pay for the goods and services needed in their supply chain. This method of pricing-in the carbon goes through the chain from one end, the carbon consumer (citizen), to the other, the carbon producers (the oil/gas/coal extraction companies).

Every product or service that is bought and sold would be subject to the system: every vendor, merchant, or shopkeeper must put the carbon price on their product or service next to the cash price, even if it is truly a zero emissions product. It thus provides a practical solution for difficult industry sectors like aviation, shipping, inbuilt or imported emissions, public services or the military.

Carbon tokens flowing through the supply chain in this way would act on the economy as a currency, affecting every product or service which exists and is for sale, from televisions to train tickets, and requiring two figures on the price tag – a price in local currency ($, £, €, ¥ etc) and a carbon price in tokens.

Each product or service’s carbon price will be kept up-to-date by the businesses in the supply chain, from manufacture right through packaging, freight, and storage. The final carbon price to the end consumer is simply the accumulation of carbon token costs that were added on and demanded in payment at each step of the way. This establishes a direct link between the volume of carbon tokens allocated by the central carbon bank and the final CO2 emissions produced in the economy in any one period.

One significant advantage of carbon tokens is this continual dynamic update of the carbon price charged for each product or service as business becomes more carbon-neutral. The price tag will display exactly how much CO2 in total was generated in the manufacture and supply of the product and will be reduced by the vendors as emissions improvements occur. Producers will pass on CO2 emission reductions to customers by reducing the carbon token price – to balance their carbon budget but also to keep ahead of the competition.

This real-time ‘green flag’ lends a dynamism to the decarbonisation process on a scale impossible to achieve by any bureaucratic mandates or carbon tax.

Such a scheme would immediately incentivise businesses to seek out the lowest emission options in their supply chain, so that their products have the lowest carbon price they can manage and the best chances against their competitors. Products or services which currently sell for a high cash price due to their low CO2 emissions, high sustainability or eco-friendliness will actually become much more attractive due to their low carbon price.

Role of the fossil fuel industry

The other key actors in the system are the carbon producers – the oil, gas and coal suppliers.

Every gas or oil well and coal mine operation would be subject to upstream metering to measure the quantity of fossil fuels extracted (whether sold or wasted or escaping), thereby setting the quantity of carbon tokens payable to the government under the terms of their license to operate.

This supply-side control and restriction on fossil fuel extraction directly limits carbon output into the economy and so guarantees decarbonisation.

The carbon producers need to obtain the required carbon tokens by charging carbon tokens on their fossil fuel sales, weight for weight in tonnes and kilos of carbon, which is how the carbon tokens are denominated. The corporate carbon accounts would be subject to audit by the central carbon bank. All carbon extracted – gas, oil, coal – would require surrender of the equivalent carbon tokens.

Compliance in the whole carbon currency system would take place at the carbon producers, who become the lynch-pin for policing of fossil fuel extraction and thus CO2 emission reductions. It is the extraction of fossil fuels that is monitored and audited rather than their sale, because the fossil fuel producers in many cases use their own products to power their operations, or even allow their escape, e.g. methane leaks or flaring.

This at-source auditing polices the entire system and ensures the value of the carbon tokens – no tokens means no fossil fuel.

Downstream companies in the petrochemical industry and beyond in wider industry which do not extract fossil fuels would, by definition of the system, not be subject to metering or payment of carbon tokens to the carbon bank.

Infrastructure to implement the policy

The infrastructure involves:

- Customs office imposing the carbon price at the border

- Carbon market

The Central Carbon Bank

- takes instruction from the government advisory body setting the national carbon budget

- oversees the creation of carbon accounts

- runs the carbon market for buying and selling tokens

- controls the carbon producers

- monitors the carbon token supply in the economy

Carbon Border

Businesses mainly complain that any attempts to reduce their CO2 emissions will result in a loss of competitiveness and market share as their customers switch to cheaper, imported high-carbon alternatives.

To prevent this, the customs office estimates the CO2 emissions created in the production of imported goods, and levies that on the domestic importer, only allowing release of the import on payment of the tokens due.

The Carbon Market

The ability to purchase extra carbon tokens from citizens or businesses would minimise problems when adaptation is slow or insufficient.

Citizens wishing to maintain a higher carbon footprint could buy extra carbon tokens to subsidise their carbon-intense choices, but only what other people are selling, and that will decrease regularly as the carbon allowances are steadily reduced. Such a market for tokens is not a loophole that some observers might think prevents actual CO2 emissions reduction from taking place, because firstly, not allowing the sale of tokens could encourage people who would otherwise be carbon-conscious to use up all their un-tradeable allowance on cheap high-carbon products. Secondly, the market for buying and selling carbon tokens represents a safety mechanism in the system that prevents people or businesses falling off a carbon “cliff edge” if they run out of tokens.

How we can implement the policy

The carbon allowance policy can be implemented by any nation that has decided on clear CO2 emissions reduction targets and has the ability to set up the carbon border to protect the domestic economy.

The roll-out could be implemented by a carbon bank within a single nation or within trading blocs by the creation of carbon borders with non-implementing trading partners.

The customs authorities act as proxies and impose the carbon price on the imports at the border. In addition:

- the central carbon bank makes regular allocation of carbon allowances to citizens

- the carbon bank runs the carbon market where citizens and business come to sell surplus tokens or obtain extra requirement

- carbon tokens would not expire

- the carbon bank charges interest on the carbon tokens in the accounts in order to discourage stockpiling

- the carbon bank monitors the carbon token supply in the economy to manage any over- and under-supply. This information would feed back into the decision-making process for calculating the optimal quantity of tokens to allocate for each period to remain on target for emissions.

- processes the audit, verification and payment of carbon tokens from the carbon producers

National Implementation

Any nation or trading bloc could implement the policy, by the customs authority setting up a carbon border and acting as a proxy to impose the carbon price required on incoming goods, paid by the domestic importer. A nation’s customs agency would act as proxy for an international carbon currency system.

More on carbon borders here.

Other nations could join with the first nation at any point to form a larger trading block.

International Implementation

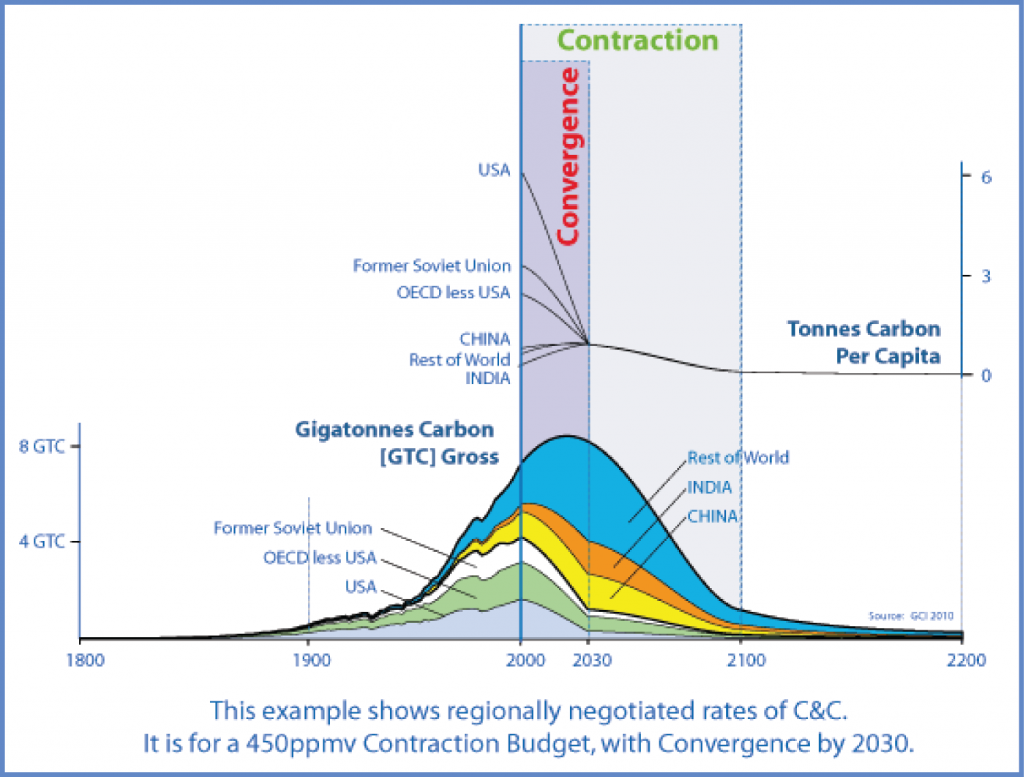

One solution to provide a basis for carbon allocation between nations would be the Global Commons Initiative’s Contraction and Convergence Framework[7]. This is the essence of decades of international climate diplomacy, as used by UNFCCC, UK Government, the Brazilian, Russian, Indian, and Chinese delegations and as a basis for proposals by various organisations and political parties ever since[8].

On an international scale ultimately all citizens from all nations would receive the same individual allowance of carbon tokens. This would start differently for different countries yet end up the same by global agreement, using a UN-brokered convention based on the Contraction and Convergence system.

The chart below shows, at the top, the annual rates of carbon emissions allocated (tonnes carbon per capita per country), and below, in gigatonnes of carbon total per country (from 2000).

It illustrates how national allocations can be negotiated to the satisfaction of all countries by commencing at different per capita levels and then converging at an agreed point before contracting.

Cost of Implementation

Compared to the “free” option of doing nothing or “business as usual”, the carbon allowance policy has a large, up-front cost with manageable, contained, on-going running costs similar to VAT or German MwSt.

The large up-front cost comes as business, government and citizens prepare for its introduction. Studies in 2008 in the UK and more recent studies on projects such a road traffic in Kenya and local transport in Finland show that costs are not prohibitive. There is already potential infrastructure that could be repurposed at very low cost, for instance the Bank of England’s CBDC (central bank digital currency) which is not in use.

The costs to the state required to implement the system would be small in comparison to the billions proposed for climate-related subsidies and government spending programmes.

Advantages of this approach

No requirement for carbon labelling laws: the carbon price of every item creates itself via cumulative addition up the supply chain. The system results in a dynamic, responsive carbon price for everything with no requirement for government to research and label everything with a fixed, statutory carbon price.

Transparency in commerce: people and green businesses currently base their consumer choices on information that is often not on the label, is incomplete, or worse, is misleading or purposefully suppressed. Very few things have the same carbon transparency as buying a tank of fuel to drive somewhere. There are unexpected inputs, hidden subsidies and incalculable interactions which make some things’ actual carbon footprint differ radically from the expected. This system’s cumulative supply chain carbon price irons out these issues and distributes the effort of setting the carbon price to the place where it is most easily done – by the people creating the product or delivering the service.

Transparency in the fossil fuel industry: the metering of fossil fuel extraction at source gives a direct measure of the carbon entering the economy and the CO2 emissions produced. Progress would be clear to all. The significance of government or central carbon bank decision-making within the system would also be readily understood.

Direct control over fossil fuel supply: because there is a one-to-one relationship between carbon tokens and the all the oil, gas or coal that fossil fuel producers are permitted to extract from the ground, the government’s control over how much fossil fuel is produced and how much CO2 is emitted is direct, unlike the situation with carbon tax, where the impact on CO2 emissions is dependent on the economy’s reaction to the carbon tax.

Driver of green innovation: progress towards a zero emissions economy in any circumstances will only occur at a fast enough pace if inventiveness and innovation can be harnessed to create new methods and processes. Because every individual will develop a solid carbon literacy through their everyday use of their own personal carbon account, people will bring this into their work and drive the economy’s adaptation to the system from the inside out. Compare this with the impact of carbon taxes: worldwide implementation of carbon taxes in 2020 covered only 16% of the economy, leaving the “carbon price gap” standing at 84%[8]World Bank: State and Trends of Carbon Pricing 2020 (World Bank, Washington DC). The coverage of the proposed carbon currency system would be practically 100%. So the inherent “price signal” for carbon under the carbon currency system would be 5 times stronger than from carbon taxes as it stands. The stronger impact would accelerate business adaptation and innovation.

Cross-border trade: any nation or trading bloc using this system instructs its customs authority to set up a proxy at the border to impose an estimated carbon price on incoming goods, which is paid by the importer.

Facilitation and promotion of carbon drawdown: the government has a national budget for carbon allowances which it uses to allocate every citizen’s allowance. It can pay in carbon tokens from this budget for atmospheric CO2 removal, e.g. in soils via sustainable farming practices, rewilding, the protection of ocean carbon sinks or any kind of mechanical carbon drawdown. Recipients would be able to sell the carbon tokens they earn at the going rate. The higher the carbon token price, the more it would promote carbon drawdown.

Introduction with sufficient allowance for average citizens: the introductory level of carbon tokens at the level of the average carbon footprint would be adequate to bring about familiarity with the carbon currency without entailing an immediate change in the average person’s lifestyle choices. Only the most profligate carbon emitters would actually find themselves restricted during the first years of the system’s implementation. This tends to be a small number of wealthy people who constitute only a tiny proportion of the electorate. Most would agree such people should rein in their carbon-intensive activities.

Long term impacts ameliorated by advances in technology: it is probable that the progress of green technologies in the future will reduce the required carbon tokens in many sectors, cushioning the impact on consumers when allowance reductions start to cause significant reductions in the availability of emissions-intense products.

Comparison with other approaches

Carbon tax is always criticised for its unfairness because those with lower incomes generally end up paying proportionately more of their income for it, but carbon allowances are allocated equally per capita, and allow those on low incomes who have on average smaller carbon footprints to profit from selling their excess.

Carbon tax is also quite complex and it is difficult to construct a carbon pricing system and then to implement it using policies that can only implement partial coverage. Multiple issues occur, especially on a political level e.g. in British Columbia, Canada[9]Corkall, V., Gass, P.: Locked In and Losing Out: British Columbia’s fossil fuel subsidies (IISD)[10]Campbell, K.: Amid calls for stronger carbon levy, P.E.I. PCs vow to keep cutting gas taxes (CBC News) and in the EU[11]Just, S.: The carbon price thaw: Post freeze future of GB carbon price (Aurora Energy Research).

Other attempts to control society’s widespread and deeply rooted CO2 emissions via the creation of a multitude of decarbonisation mandates in government have also not had the desired effect. The problem with regulation-based policies is the extended time horizons associated with such policies. The EU in 2020 displayed a particularly egregious example of this. The implementation of the ‘EU Green New Deal’ will only take force 10 years down the line in 2030 and it does not allow for greater ambition until 2035.[12]Abnett, K.: Environment groups say EU’s planned climate law means a lost decade (Reuters)

The carbon allowances policy has an advantage over every other kind of carbon pricing policy, because other policies attempt to guess the “right” price for carbon, without knowing in advance how great its impact will be, because they are not comprehensively applied to all sources of CO2 emissions and they suffer from variations in the sensitivity of supply and demand. We roughly know the quantity of CO2 emissions we can allow for various global warming scenarios, so it is more robust approach to use that figure to set a per capita allowance.

Many climate policy discussions would be solved by this policy’s broad coverage. It’s simpler, more efficient and more direct to control the quantity of carbon entering the economy than the carbon price, which is fundamentally a difficult policy making exercise, prone to failure and political intervention. They rely on inclusions and exclusions on a sector by sector basis and variation in carbon accounting practices dependent on national law. Carbon allowances on the other hand would provide comprehensive coverage of the economy and a comparatively small set of economic indicators, influences and unknowns. This would provide the backdrop for a reliable investment framework that gives a clear pathway for innovation towards carbon neutrality.

Shipping illustrates a typical problem businesses face. The International Maritime Organisation brokered a international agreement that shipping fuel must be used more efficiently by 2020, but despite 20 years preparation, it is on the verge of failure because of disagreement over who bears responsibility in the industry[13]Financial Times: What we can learn from the 2020 shipping fuel switch (Financial Times). The carbon allowances policy would enable an individual nation to include shipping under its umbrella via the customs proxy mechanism described above to solve international responsibility issue, and the fuel costs would carry the carbon costs, solving the ownership issue.

Carbon taxes are much cheaper and a good place to start, but it is not enough[14]Read this Bloomberg article on why carbon taxes fail to do enough and ultimately it does not directly control fossil fuel supply if people are prepared to pay more. Carbon taxes or emissions trading schemes in sector-by-sector programs on a nation-by-nation basis are subjectively implemented and prone to political drag, and only ever partially successful, as reported in EU ETS industrial energy reviews, UK government research briefings[15]UK gov’t research briefing here: the effect of the UK carbon price floor, the Norwegian carbon tax[16]Norway’s carbon tax: https://www.sciencedirect.com/science/article/pii/S0301421503001514, the Swedish carbon tax[17]Should every country copy Sweden’s carbon tax?, and the Suzuki Foundation carbon tax overview[18]David Suzuki: carbon tax vs cap’n’trade.

Carbon taxes and emissions trading schemes never cover everything, typically leaving out emissions for imported products, aviation, shipping, the public sector and other ‘difficult’ sectors.

- Carbon taxes for instance are unfair, difficult to target and subject to far more political interference.

- A carbon tax with a “people’s dividend” sounds ideal – but the experience from British Columbia in Canada is that the system tends to turn into a political shitstorm.

- Emissions trading schemes are complex and difficult to administer effectively, sometimes going badly wrong.

- Government regulations such as frequent flyer tax or meat production licensing is unwieldy and piecemeal in approach.

- Finally, many people think we just need to leave it up to the markets and that the resulting technological progress will sort us out. This is actually happening – this is the “Energy Transition” – however it is too slow and we need a way to accelerate it. And of course it would be nice to have a guarantee – what happens if the market decides humans aren’t worth it?

Carbon taxes, trading schemes, legislative bans or subsidy programs also have significant workload and running costs to maintain the level of carbon policymaking:

- establishing what citizens and industry have to stop doing

- democratically agreeing on it

- legislating for it

- implementing the laws

- monitoring the effects

- constantly strengthening the laws in the face of political opposition

And all this would be repeated for each individual policy for every nation in the world.

So the carbon tax alternatives are initially cheaper, but they have higher legislative costs as governments manage decarbonisation, legislating year after year to keep up with economic and technological developments and unforeseen issues. The longer it lasts, the more likely it is that the carbon allowance policy turns out cheaper.

| Fee & Dividend Carbon Tax | Carbon Allowances | Emissions Trading Scheme | |

|---|---|---|---|

| Engagement | Upstream (engages with primary energy producers & importers) | Downstream (engages with all) | Mid-stream (engages with energy use within power generation and heavy industry) |

| Enforcement | Upstream | Upstream | Mid-stream |

| Price-based / quantity-based? | Price | Quantity | Price (despite misleading ‘cap & trade’ terminology) |

| Revenue generated from | Tax on primary energy producers & importers | None | Auctioning of allowances |

| Revenue used for | Given to citizens | No revenue in 1st place, but allowances given to citizens | No binding agreement on revenue use |

| Extent of coverage of economy | Depends entirely on scope | Full coverage | Only power generation and industry |

Carbon taxes, carbon pricing, cap-and-trade, subsidies, partial bans, trading schemes and all other policies are open to abuse from the start by loopholes, lobbying, special interests, simple omissions, public disaffection, and political campaigns. A carbon currency based on carbon allowances is a comprehensive umbrella framework and would be by nature more independent and robust in the face of external influences. On setting a total carbon budget at a certain level, the end result in reduction of CO2 emissions is known in advance.

If you want to see this proposal land on the desks of governments, central banks, and intergovernmental organisations like the United Nations, please become one of Ecocore’s financial patrons by signing up and donating a small regular amount at Patreon

![]() .

.

Carbon Allowances as a Carbon Currency, also known as Universal Carbon Credits as a Carbon Currency, and as Total Carbon Rationing by Adam Hardy MSc FRSA and Prof Steve Keen, Distinguished Research Fellow, UCL is licensed under Creative Commons BY-NC-ND 4.0

Carbon Allowances as a Carbon Currency, also known as Universal Carbon Credits as a Carbon Currency, and as Total Carbon Rationing by Adam Hardy MSc FRSA and Prof Steve Keen, Distinguished Research Fellow, UCL is licensed under Creative Commons BY-NC-ND 4.0

More on Carbon Allowances

Appendix 1: Previously Known As

For the benefit of search engines.

The system’s original name “Total Carbon Rationing” contains the word “Total” because every product or service that is bought and sold is subject to the system: every vendor, every merchant, every shopkeeper, every business person who sells anything must put the carbon price on their product or service next to the usual price, even if it is truly a zero emissions product.

It was later given the title “Universal Carbon Credits”.

In 2022 we developed a communications strategy that called for simpler vocabulary: hence it became the “carbon currency based on carbon allowances”.

Appendix 2: Example of Carbon Tokens Usage in Business

For simplicity’s sake, imagine that the UK has implemented the policy unilaterally. The UK carbon bank will then work in tandem with the customs authorities to impose the carbon token price on all goods and services coming in from other countries. Now say you want to buy a television, for instance. How do the carbon tokens fit into the commercial process?

- The UK carbon bank has allocated all citizens an equal amount of carbon tokens, reflecting absolute tonnes and kilos of carbon. When you choose a TV in a retail outlet, the price tag will show both the price in sterling and the price in tokens, and in all the preceding business transactions leading to the TV arriving in the shop, there will have been these joint costs – money and tokens.

- The TV is made from component parts, some originating in the UK, others from abroad. The plastic casing, in this example, was made in the UK so already has incurred a carbon cost which the case-maker will need to recoup when the TV manufacturer buys it. Making the case used a lot of energy and requires plastic, so the case manufacturer worked out the carbon cost in tokens by adding (a) the tokens paid to the energy provider, and (b) the tokens paid for the petrochemicals to make the plastic.

- The energy provider might be using gas or coal, wind or nuclear, but let’s say it’s North Sea gas from BP, so the energy provider had to pay BP the tokens per tonne of gas bought. BP is one end of this production chain, and will be paying the UK carbon bank carbon tokens representing a tonne of carbon for every tonne of carbon in the gas it pumps out of the North Sea.

- The TV manufacturing business has now bought the component parts, paying the required tokens, and makes the television, using more energy.

- The final calculation for the TV manufacturer is: carbon price = ( tokens needed for parts + tokens paid for energy )

- All tokens expended must be recouped from its customer, the retailer.

- Now the retailer purchases the television from the manufacturer, paying the tokens required, and prices it for sale, slightly increasing the tokens demanded of the final customer because it has to keep its shop warm in winter, and pay to transport the televisions.

- Finally you, the customer, go to the retailer and choose the television, gauging the price as usual and also the carbon price in tokens, and paying both money and tokens in one transaction.

- So the four-step cumulative carbon price in tokens for the TV looks like this:

- A for the energy costs, in tokens, for North Sea gas extracted by BP, paid first by the energy provider and then after the energy is generated, by the plastic case manufacturer

- plus B for the added carbon costs of the imported screen and other component parts, paid for by the TV manufacturer

- plus C for the energy costs of production, added by the TV manufacturer

- and finally D for the extra energy costs of storage and transport added by the retailer.

- All four costs are eventually met by the customer’s token purchase price.

- Passing on the cost of carbon priced in tokens in this way makes the primary carbon producers (in this case BP) the ultimate recipients of tokens, and the key audit point – regular audits will be carried out by the carbon bank to assure compliance between the quantity of fossil fuels extracted from the ground and the tokens that they procure via their sales of those fuels.

Appendix 3: Methane Control under the Carbon Allowances System

CH4 is a highly potent greenhouse gas, 28 times greater than CO2 over 100 years (or 84x over 20)[19]US EPA: Understanding Global Warming Potentials (United States Environmental Protection Agency). Methane leakages from fossil fuel extraction, mining for minerals such as copper[20]Azadi, M. et al: Transparency on greenhouse gas emissions from mining to enable climate change mitigation (Nature Geoscience), farming of ruminant mammals, solid waste management and several other activities are problematic areas for emissions control policies due to the significant quantities of non-CO2 greenhouse gases that are emitted. In most cases though they are already well-regulated industries, so lending themselves to coverage by the carbon allowances system. This can be done by licensing the operation to emit greenhouse gases against purchase of a license, priced in carbon tokens according to the quantity to be emitted, calculated as C02e (CO2 equivalent).

Based on past mining or drilling operations and including geological data indicating potential methane leakage from oil or coal beds, average methane leakage at any extraction site could be calculated and the appropriate carbon price added to the final bill at the carbon producer’s audit by the carbon bank.

Oil and gas wells and coal mines would be metered as described above not just for usable fossil fuels but also for leakage. Monitoring operations can be highly effective and led to the detection of the massive methane leaks from Exxon wells in Ohio[21]Pinckard, C.: Satellite data shows Ohio methane leak one of largest ever recorded (Cleveland.com News Agency) and from Texas[22]Kessel, J.M., Tabuchi, H.: Texas Methane Super-emitters (New York Times). Such monitoring is also carried out by satellite.

Methane emissions from solid waste management and composting could also be done this way. Remote sensing is already used in California as part of pollution control research[23]IOPScience 2020: Using remote sensing to detect, validate, and quantify methane emissions from California solid waste operations (IOP Science).

Methane emissions from livestock by a farmer with a dairy or beef herd would be required to pay license fees in carbon tokens per head of cattle.

Appendix 4: Preservation of Natural Carbon Sinks and Prospects for Carbon Drawdown

The implementation of the carbon allowances system could provide a carbon token-based income to the owners or guardians of every standing forest. The forest carbon sinks sequester about 15% of anthropogenic CO2 emissions[24]Hubau, W., Lewis, S. et al: Asynchronous carbon sink saturation in African and Amazonian tropical forests (Nature), although that rate is falling. From the opposite perspective, deforestation for economic gain would have to be monitored and audited by a global carbon bank, which would then demand the equivalent carbon tokens from the entity carrying out the deforestation. The concept applies that all carbon usage and ensuing CO2 emissions in the economy must be paid for in carbon tokens.

The demand for biofuels would also be channelled into sustainable practices. Industrial biofuel agriculture[25]FAO: The State of Food and Agriculture, Part I: Biofuels: Prospects, Risks and Opportunities (FAO) would need to budget for payment of carbon tokens for CO2 loss due to soil degradation. Large woodchip-fired power stations would pay in carbon tokens for woodchip from forestry operations, who would be subject to audit and payment to the carbon bank for the forest clearance. Future developments with current 2020 policies could otherwise lead to unchecked deforestation.[26]Sandbag: Playing With Fire: assessment of company plans to burn biomass in EU coal power stations (Sandbag)[27]Carbon Pulse: EU’s wood-fired power should face carbon price under tougher rules (Carbon Pulse News Agency)

The continued destruction of the globally significant carbon sinks, such as the rainforests of the Amazon, Borneo and the Congo, represent a large risk to any attempts to control CO2 emissions globally. The obvious culprit here is the palm oil industry with its extensive oil palm plantations, along with timber production, soya or beef farming forest clearance methods, and other drivers of deforestation by commercial interests. A global pact to implement the carbon allowances policy could create a global carbon budget for carbon tokens large enough to supply payments for carbon sinks as detailed above.

In parallel to the requirement for keeping forests standing, the carbon allowance policy offers a huge potential as a mechanism to pay for negative emissions. For instance, all deforested land could be reforested. As trees grow, they absorb CO2 from the atmosphere. Reforestation projects can claim this weight of absorbed CO2 as carbon tokens from the carbon bank.

Obviously under this system, forest stewards of both intact primary forest and regrowing secondary forest would have to be subject to stringent control to the same degree as the gas/oil/coal carbon producers.

The forest condition and the amount of carbon absorbed (or lost through felling) would be monitored by remote sensing in the same way that forests are currently monitored.[28]Bae, S., Levick, S.R., Heidrich, L. et al.: Radar vision in the mapping of forest biodiversity from space. (Nature Communications 10, 4757)[29]Almeida D. et al: Monitoring the structure of forest restoration plantations with a drone-lidar system (International Journal of Applied Earth Observation and Geoinformation)

Appendix 5: More Robust Future Carbon Offsetting and Voluntary Carbon Markets

The harsh reality of CO2 emissions and prospects for their reduction means any realistic plan must include removing CO2 from the atmosphere, or global warming will overshoot 1.5°C[30]Andrew, R.: Global Carbon Budget 2019 (CICERO Center for International Climate Research).

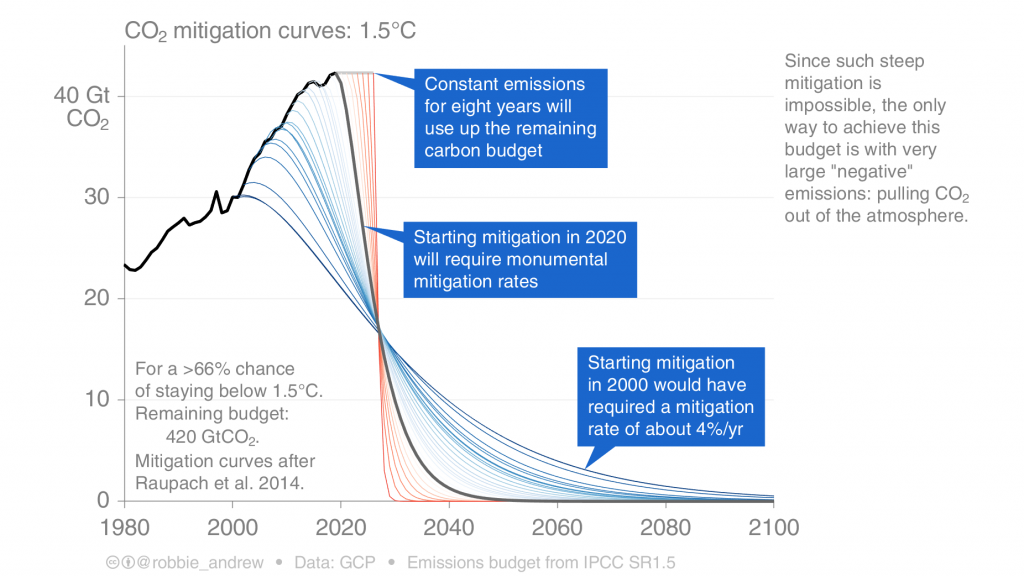

This chart displays the Global Carbon Budget. It shows annual global CO2 emissions on the Y axis in gigatonnes. In 2019 when created, the thick black curve has risen every year on the X axis. The cumulative effect of all emissions to date has resulted in a global temperature rise of 1°C above pre-industrial levels.

The 2015 Paris Climate Agreement between all nations targets a 1.5°C limit to global warming, with initial commitments to keep the temperature rise “well below 2°C”.

According to the latest climate science, to achieve a limit of 1.5°C warming, society must restrict further CO2 emissions to less than 420 gigatonnes. The downward-arcing black line on the chart displays how annual emissions must decline if we adhere to the 420 gigatonne total. In other words, with current emissions at 42 gigatonnes per year, if we carried on for another 10 years, we would then need to completely stop all emissions or global warming would exceed 1.5°C.

As the chart text states, such sudden emissions reduction is practically impossible. The only way to keep the total extra anthropogenic CO2 added to the atmosphere below 420 Gigatonnes from 2020 is to pull CO2 out of the atmosphere – “negative emissions”, in the appropriate huge quantities.

Using its ability to take carbon tokens from its national carbon budget as described above, the central carbon bank would promote “negative emissions” by awarding tokens to people or businesses capturing CO2, e.g. growing trees or building futuristic Saharan solar power stations that generate power to turn CO2 from the atmosphere back into carbon[31]Cockburn, H.: Scientists turn CO2 ‘back into coal’ in breakthrough carbon capture experiment (Independent UK) or salt crystal[32]Rathi, A.: You can now pay to turn your carbon emissions to stone (Quartz Global News) or methanol and oxygen[33]Weston, P.: Scientists create ‘artificial leaf’ that sucks in carbon dioxide and makes fuel (Independent UK). This branch of industry is no longer in its infancy as summarised by Carbon Brief in their report “10 Ways Negative Emissions could slow Climate Change”[34]Pierce, R.: Explainer: 10 ways negative emissions could slow climate change (Carbon Brief) but requires the investment to scale up.

However as of 2020 the whole industry is not without controversy in the way that its CO2 drawdown is certified. In fact it is difficult to draw the line between this and the carbon offsetting industry. It is in these sectors that the rigour and robustness in validation and payments by a centralised carbon bank would be transformational.

Not only would it promote research and investment into reforestation and carbon sequestration, but because the central carbon bank awards tokens from the central carbon budget, it circumvents the problem of who should pay for it. The main issue would be monitoring land use and other carbon drawdown mechanisms, and administering claims.

References

| ↑1 | Climate Action Tracker on government climate promises’ credibility gap |

|---|---|

| ↑2 | The European Investment Bank 2022 climate survey: citizens call for green recovery: calls for a green recovery |

| ↑3 | “The current economic systems will not cope” says the Bank of England |

| ↑4 | See the University of Exeter‘s work on the energy policy needed to deliver Net Zero |

| ↑5 | UK Committee on Climate Change: Net Zero 2050 Strategy UKCCC |

| ↑6 | UK Parliament Commons Select Committee 2019: Government’s target for ‘net-zero’ by 2050 undeliverable unless clean growth policies introduced (UK Parliament) |

| ↑7 | Workman, M. et al, 2020: Decision making in contexts of deep uncertainty – An alternative approach for long-term climate policy Science Direct |

| ↑8 | World Bank: State and Trends of Carbon Pricing 2020 (World Bank, Washington DC) |

| ↑9 | Corkall, V., Gass, P.: Locked In and Losing Out: British Columbia’s fossil fuel subsidies (IISD) |

| ↑10 | Campbell, K.: Amid calls for stronger carbon levy, P.E.I. PCs vow to keep cutting gas taxes (CBC News) |

| ↑11 | Just, S.: The carbon price thaw: Post freeze future of GB carbon price (Aurora Energy Research) |

| ↑12 | Abnett, K.: Environment groups say EU’s planned climate law means a lost decade (Reuters) |

| ↑13 | Financial Times: What we can learn from the 2020 shipping fuel switch (Financial Times) |

| ↑14 | Read this Bloomberg article on why carbon taxes fail to do enough |

| ↑15 | UK gov’t research briefing here: the effect of the UK carbon price floor |

| ↑16 | Norway’s carbon tax: https://www.sciencedirect.com/science/article/pii/S0301421503001514 |

| ↑17 | Should every country copy Sweden’s carbon tax? |

| ↑18 | David Suzuki: carbon tax vs cap’n’trade |

| ↑19 | US EPA: Understanding Global Warming Potentials (United States Environmental Protection Agency) |

| ↑20 | Azadi, M. et al: Transparency on greenhouse gas emissions from mining to enable climate change mitigation (Nature Geoscience) |

| ↑21 | Pinckard, C.: Satellite data shows Ohio methane leak one of largest ever recorded (Cleveland.com News Agency) |

| ↑22 | Kessel, J.M., Tabuchi, H.: Texas Methane Super-emitters (New York Times) |

| ↑23 | IOPScience 2020: Using remote sensing to detect, validate, and quantify methane emissions from California solid waste operations (IOP Science) |

| ↑24 | Hubau, W., Lewis, S. et al: Asynchronous carbon sink saturation in African and Amazonian tropical forests (Nature) |

| ↑25 | FAO: The State of Food and Agriculture, Part I: Biofuels: Prospects, Risks and Opportunities (FAO) |

| ↑26 | Sandbag: Playing With Fire: assessment of company plans to burn biomass in EU coal power stations (Sandbag) |

| ↑27 | Carbon Pulse: EU’s wood-fired power should face carbon price under tougher rules (Carbon Pulse News Agency) |

| ↑28 | Bae, S., Levick, S.R., Heidrich, L. et al.: Radar vision in the mapping of forest biodiversity from space. (Nature Communications 10, 4757) |

| ↑29 | Almeida D. et al: Monitoring the structure of forest restoration plantations with a drone-lidar system (International Journal of Applied Earth Observation and Geoinformation) |

| ↑30 | Andrew, R.: Global Carbon Budget 2019 (CICERO Center for International Climate Research) |

| ↑31 | Cockburn, H.: Scientists turn CO2 ‘back into coal’ in breakthrough carbon capture experiment (Independent UK) |

| ↑32 | Rathi, A.: You can now pay to turn your carbon emissions to stone (Quartz Global News) |

| ↑33 | Weston, P.: Scientists create ‘artificial leaf’ that sucks in carbon dioxide and makes fuel (Independent UK) |

| ↑34 | Pierce, R.: Explainer: 10 ways negative emissions could slow climate change (Carbon Brief) |