Updated on 2022-12-16 by Adam Hardy

Many people who are worried about fossil fuel use have switched to domestic providers who offer expensive yet cheap wind and solar with low to zero CO2 emissions. The “cheap” price of renewable energy though isn’t helping with cost of living crisis. We know why the price of gas is off the scale. Even in 2021 already before the Ukraine war, Putin started cutting off the supply of natural gas piped to Europe from Russia.

The price of gas rose from 4p/kWh in 2021 to 15p or almost quadruple in autumn 2022. In the UK, we might not import gas directly from Russia, but the gas network is basically one huge pipeline, so there is only one price.

Because a lot of electricity is generated in gas-fuelled power stations, the price of electricity has shot up too, from 21p/kWh to 52p or almost treble.

With the huge prices for fossil fuels, the fossil fuel providers are making windfall profits through their intimate knowledge and experience of fossil fuel supply chains and markets. In a climate crisis where there are significant existential risks to civilisation if the world doesn’t decarbonise the global economy, the situation is obscenely ironic. Yet the way the energy market operates, every energy customer no matter how green they are or which provider they use has to pay those prices.

The energy market isn’t like any other for several reasons:

- energy generators can be either on demand (dispatchable) or weather-dependent

- electricity cannot currently be stored at a reasonable cost

- the wholesale market for energy generators is either spot (market price) or forward (contracted – essentially bulk buying)

- the domestic market – householders and businesses – allows for uncontrolled consumption of energy

- there is no direct contract between the energy generators and the end customers, unless the customer has signed up with a community energy scheme owning a solar farm or wind turbines

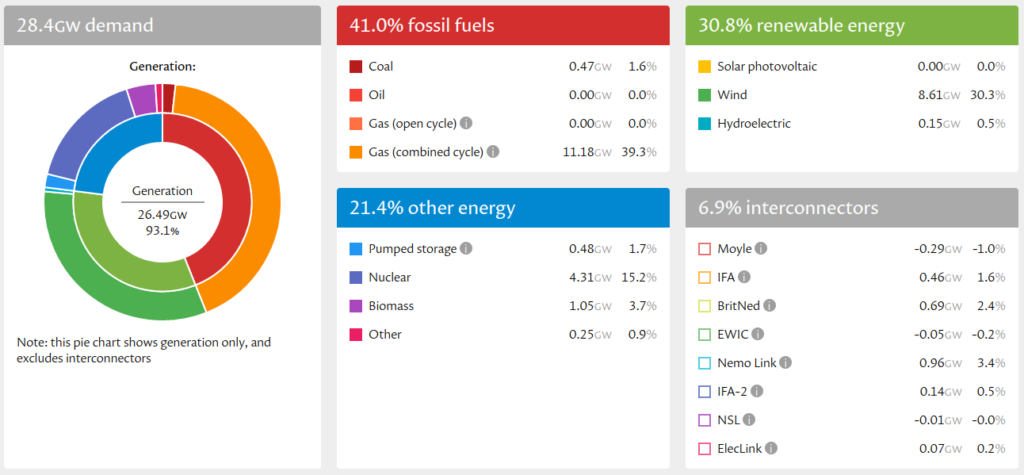

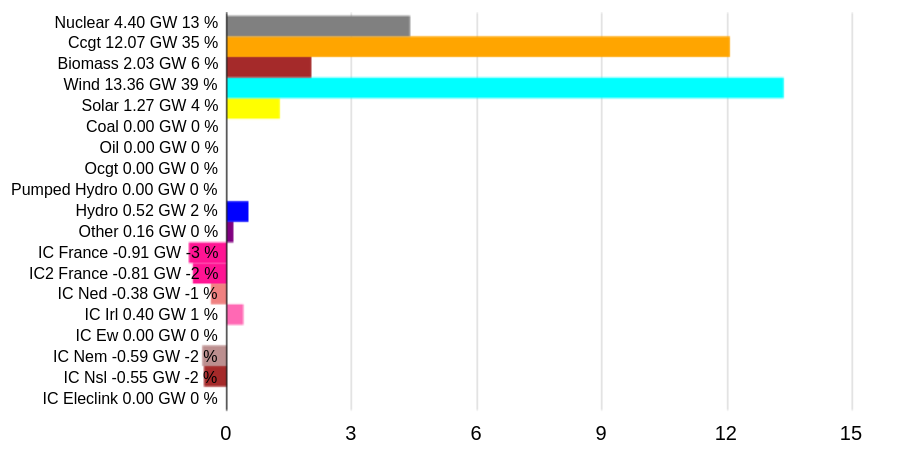

- the National Grid PLC running the whole system, predicts demand, balances supply from expensive fossil fuel power stations, cheap wind and solar, hydro, nuclear and the inter-connectors with foreign grids, and ensures there’s no wasted production or risk of black-outs

- the so-called “marginal price” of electricity (the price per unit or kilowatt-hour (kWh) – a term borrowed from economics) varies from generator to generator

During the early hours of the night when energy demand on the national grid is lowest, the cheapest generation – hydro and wind – supplies a much greater proportion of the mix. So the supply is at its greenest and cleanest. But as demand on the grid increases to a daily peak between 4pm and 7pm, expensive fossil fuel-fired power stations supply more and more energy on the spot market. Peak time electricity is the dirtiest, because it is produced by the most expensive, mostly fossil fuelled power stations.

The UK National Grid’s energy market runs a reverse auction every 30 minutes, at which point energy generators compete to sell their energy to the grid. Units of energy produced and delivered to the grid during each half hour are paid at the same price, i.e. the highest price of the winning lowest offers for the amount of energy required.

One useful approach for households to reduce emissions would be to run all machines (washing machines, dryers, dishwashers, even freezers) on timers overnight. Signing up for a dual-tariff (day/night, or economy) would make it cheaper as well.

When cheap wind and solar suddenly get expensive

The problem with the way the market works is that the cheap wind and solar suppliers know what the minimum price for gas generated energy is, so they jack their prices up to the same level as gas during the peak hours when it’s a safe bet that demand on the national grid will require the gas-fired power stations as well as all the renewables they can supply.

This might make some great headlines about grasping greedy corporations, especially when the profits are channelled back to shareholders as dividends, but in this industry, no-one is doing anybody any favours and there are many other factors that make this a risk-fraught business for generators and suppliers. The sudden fall in demand during the COVID lockdowns of the pandemic caused several imprudent suppliers to go under.

According to the free-market-solves-everything mantra, this situation will remedy itself as the renewables companies invest their profits in expansion, making more cheap wind and solar energy and ousting fossil fuels completely. However government red tape and slow infrastructure development are holding renewables back so this investment is only happening slowly – too slowly to reduce the CO2 emissions from the energy sector to meet climate targets.

At the time of writing, the current UK Truss administration is considering a windfall tax on renewable energy suppliers or forcing them onto long-term supply contracts at lower rates. Long-term though, the best solution is to increase renewable generation, storage (battery etc) capacity, grid flexibility and decentralisation. This will reduce the amount of expensive gas-fired energy required as well as reduce the overall demand on the national grid.

The whole situation is hugely interesting and begs the question how the energy market would operate under the carbon currency based on carbon allowances. We can run some simulations of the market under a dual pricing system on Prof Steve Keen’s Minsky platform, to see how dual pricing would work on the reverse auction wholesale market, and what impact it would have on the strength of the price signal if the carbon token price was converted to cash and added to the market cash price. Read more on the carbon currency here and our research here.

More Resources

Global Electricity Maps https://app.electricitymaps.com/zone/ES-CN-LP